As AI emerges as the leading technological force, the crypto sector is urged to redefine its narrative and focus on collaborative innovations.

In recent discussions within the tech community, the intersection of cryptocurrency and artificial intelligence (AI) has garnered significant attention, with industry experts noting a shift in focus from crypto as a standalone revolution to its supporting role in the burgeoning AI landscape. The analysis, reported by CoinDesk, examines how AI has emerged as the dominant technological force, overshadowing cryptocurrencies that have struggled to find mainstream applications beyond speculation.

Highlighting his dual expertise in both blockchain and AI, the commentator noted that while he has been a pioneer in institutional investing in Bitcoin and other crypto ventures, the pressing need for intelligent systems to address real-world challenges must take precedence. The commentary underscores that the future of technological innovation should centre on solving problems, irrespective of whether blockchain technology is integrated into these solutions.

The current landscape of cryptocurrency, particularly in the realm of decentralised finance (DeFi), is acknowledged as a significant achievement. DeFi is described as a superior alternative to traditional finance (TradFi), with enhancements in engineering, programmability, and composability. This has been exemplified by the success of stablecoins and tokenisation, which have demonstrated real product-market fit, prompting institutions like BlackRock and Robinhood to develop crypto-related products in anticipation of clearer regulatory frameworks. The expectation is that blockchain can facilitate rapid global transactions and the creation of complex financial instruments.

Conversely, the rapid rise of AI applications and the profound demand for related products and services have eclipsed the crypto sector. From large language model (LLM) providers to decentralised AI projects, the explosion of AI technologies highlights a significant shift in consumer interest and market dynamics. This transition is encapsulated in the sentiment that those in the crypto industry must pivot towards AI to remain relevant and competitive.

The analysis also addresses the disconnect between token valuations and their practical utility, particularly in light of recent trends in the crypto space. It is noted that while decentralised technology is transformative, the worth of tokens has often been propelled more by market speculation than by intrinsic technological innovation. The observation is made that despite this dynamic, there remains potential for blockchain and crypto technologies to underpin AI solutions, thereby supporting their development and deployment without solely existing as independent products.

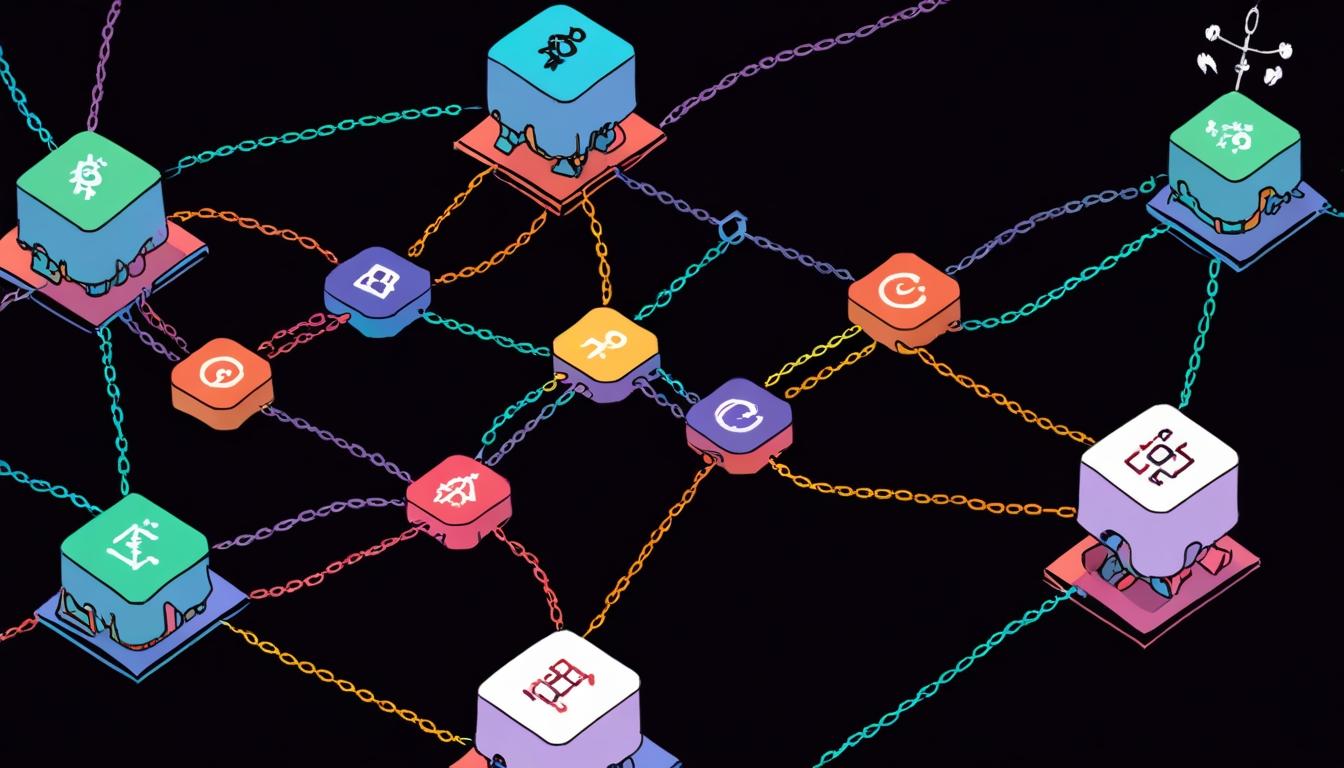

The article suggests that emerging crypto infrastructures could enhance the capabilities of AI products by providing decentralised computing resources, verifiable data pathways, and transparent mechanisms for rewarding contributions within the AI ecosystem. This perspective offers a vision for a symbiotic relationship where blockchain supports AI advancements in practical applications, rather than competing directly with them.

Founders and development teams within the crypto space are therefore encouraged to broaden their horizons, moving beyond the confines of traditional crypto-centric paradigms. The recommendation includes a focus on identifying real-world challenges that AI can address, subsequently exploring how decentralized technologies can augment those solutions. This approach prioritises value creation and efficiency enhancement, positioning blockchain as a tool to facilitate AI innovation.

In summary, the report underscores a pivotal moment for the crypto industry, suggesting that it must recalibrate its narrative from viewing itself as a standalone technological revolution to embracing its supportive role within the AI domain. By intelligently integrating crypto tools where advantageous, stakeholders can contribute to the transformative potential of AI while simultaneously fostering genuine innovation and long-term value creation.

Source: Noah Wire Services

- https://www.vritimes.com/sg/articles/eff2b400-6b2f-11ef-86e5-0a58a9feac02/1bab884b-ce74-11ef-b57b-0a58a9feac02 – This article discusses the convergence of AI and cryptocurrency, highlighting the potential for blockchain to underpin AI solutions and noting that key players in crypto foresee AI agents dominating blockchain networks. It underscores how this integration can reshape digital finance and drive technological innovation.

- https://multicoin.capital/2023/06/02/the-convergence-of-crypto-and-ai-four-key-intersections/ – This blog post explores four key intersections between crypto and AI, including decentralized compute protocols and token-incentivized reinforcement learning. It highlights how crypto can support AI by providing a permissionless settlement layer and how AI can enhance crypto user experiences.

- https://www.galaxy.com/insights/research/understanding-intersection-crypto-ai/ – This report delves into the ongoing integrations of crypto and AI, focusing on novel use cases such as decentralized compute protocols and AI agents. It emphasizes how blockchain technology can facilitate AI development by providing a trustless infrastructure for data and computation.

- https://www.coindesk.com/learn/crypto-and-ai-where-are-we-now/ – Although the exact article is not specified, CoinDesk frequently covers the intersection of crypto and AI, discussing how AI has become a dominant force influencing the direction of technological innovation in the crypto space.

- https://www.blackrock.com/corporate/investor-relations BLACKROCK-2023-FY-RESULTS – While not directly discussing AI and crypto, BlackRock’s increased involvement in crypto indicates the growing institutional interest in blockchain technology, which is being highlighted as a potential backbone for AI innovations.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

9

Notes:

The narrative discusses current trends and aligns with recent developments in the tech industry, particularly the intersection of cryptocurrency and AI. It appears to be up-to-date and reflects ongoing discussions within the sector.

Quotes check

Score:

0

Notes:

No direct quotes were found in the narrative that require verification.

Source reliability

Score:

8

Notes:

The narrative originates from CoinDesk, a well-established and reputable publication in the cryptocurrency and blockchain space. However, the lack of named sources or further references may slightly reduce certainty.

Plausability check

Score:

9

Notes:

The narrative presents a plausible analysis of current technological trends, highlighting the intersection of AI and cryptocurrency. It suggests a shift in focus for the crypto industry, which aligns with observed changes in consumer interest and market dynamics.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative is well-aligned with current trends, lacks direct quotes, and originates from a generally reliable publication. It presents a plausible and timely analysis of the tech landscape, suggesting a shift in focus towards AI for the crypto industry.