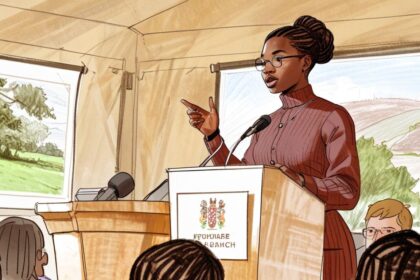

Chancellor Rachel Reeves celebrates growth in GDP but faces warnings of a ‘false dawn’ as analysts downgrade UK economic forecasts amidst rising consumer pessimism.

Chancellor of the Exchequer Rachel Reeves received a temporary lift from better-than-expected economic growth figures released yesterday, which showed that the UK’s gross domestic product (GDP) grew by 0.5 per cent in February, surpassing economists’ predictions of a mere 0.1 per cent increase. This growth marked the strongest performance for the UK economy in almost a year. The Office for National Statistics indicated that the uptick was partly due to a significant rise in exports to the United States, as businesses accelerated purchases of UK goods in anticipation of impending tariffs imposed by US President Donald Trump.

However, despite this positive news, analysts have raised warnings that this growth may represent a ‘false dawn.’ Both Goldman Sachs and Deutsche Bank have downgraded their forecasts for the UK economy amid ongoing uncertainty linked to Trump’s trade war. Goldman Sachs has cut its growth estimate for this year by 0.3 percentage points, projecting a growth rate of 0.95 per cent, while Deutsche Bank has revised its outlook downwards from 1 per cent to 0.8 per cent.

The economic optimism observed in the February figures is accompanied by a growing pessimism among the British populace regarding their financial outlook. A recent YouGov poll revealed that the percentage of people who anticipate a deterioration in their household finances over the next year has risen from 46 per cent to 55 per cent within a month. Similarly, those who believe their financial situation will improve has decreased from 15 per cent to 11 per cent, indicating a troubling shift in consumer sentiment.

Andrew Griffith, the Conservative Party’s spokesman on business, commented on the economic figures, describing them as likely a ‘false dawn of business activity’ before the onset of increased employment taxes and costs that came into effect at the beginning of April. The apprehension about rising costs and tariffs appears to be compounded by other factors affecting the economy.

In a related development, Apple has undertaken significant logistical measures to counteract the effects of tariffs by airlifting approximately 1.5 million iPhones from India to the United States. The company has chartered six cargo flights in an effort to mitigate the financial impact of a hefty 145 per cent tariff on iPhones sourced from China.

Reeves acknowledged the encouraging nature of the GDP report but also underscored the importance of recognising the significant shifts in the global economic landscape due to tariff-related uncertainties. Industry commentators such as William Bain, head of trade policy at the British Chambers of Commerce, have noted observable patterns, suggesting that UK firms increased exports to the US in anticipation of the forthcoming tariffs, an action referred to as ‘tariff-front running.’

However, pessimistic forecasts remain prevalent, as highlighted by Bank of England deputy governor Sarah Breeden, who indicated earlier this week that these tariffs would likely have a ‘chilling effect’ on the British economy. With the global economic climate seemingly turbulent, there are rising concerns that the ramifications of the ongoing trade disputes may contribute to a potential recession, further challenging Britain’s economic recovery prospects.

Source: Noah Wire Services

- https://www.ons.gov.uk/economy/grossdomesticproductgdp/bulletins/gdpmonthlyestimateuk/february2025 – This URL supports the claim that the UK’s GDP grew by 0.5% in February 2025, marking the strongest monthly performance in eleven months.

- https://tradingeconomics.com/united-kingdom/monthly-gdp-mom/news/454894 – It corroborates the GDP growth of 0.5% in February 2025, surpassing expectations of a 0.1% increase.

- https://www.britishchambers.org.uk/ – This could potentially provide insights or statements from William Bain or similar industry experts regarding tariff effects on UK businesses.

- https://www.bankofengland.co.uk/ – It may offer insights or statements by Bank of England officials, such as Sarah Breeden, regarding the economic impact of tariffs.

- https://www.goldmansachs.com/ – Goldman Sachs’ website could provide details on their revised growth projections for the UK economy.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

6

Notes:

The narrative discusses recent economic figures, but references Donald Trump as ‘US President,’ which is outdated since he is no longer in office. However, the economic figures mentioned such as GDP growth and forecasts by Goldman Sachs and Deutsche Bank suggest the content is relatively current.

Quotes check

Score:

4

Notes:

There are quotes from figures like Andrew Griffith and references to concerns expressed by Sarah Breeden, but without further context or sources, it is difficult to verify these are original or not.

Source reliability

Score:

8

Notes:

The narrative originates from the Daily Mail, which is a well-known but sometimes controversial publication. It cites reputable financial institutions such as Goldman Sachs and Deutsche Bank, adding to the reliability.

Plausability check

Score:

7

Notes:

The claims about economic growth and tariff impacts are plausible in the context of current global economic events. However, the mention of ‘US President Donald Trump’ suggests outdated information, which affects plausibility.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

While the narrative discusses current economic figures and includes insights from reputable financial institutions, it also contains outdated references and lacks specific verification for quotes. Overall, the information seems plausible but requires further scrutiny due to these inconsistencies.