Videos revealing that many luxury handbags are largely produced in Chinese factories have stirred public debate about authenticity, production costs, and consumer perceptions of prestigious brands. Experts suggest increased transparency could ultimately reinforce true craftsmanship and reshape luxury market dynamics.

A surge of online creators and Chinese factory owners have been drawing public attention to the production processes behind some of the world’s most prestigious luxury fashion brands, raising questions about supply chains, production costs, and authenticity. These disclosures, often shared on platforms like TikTok, have sparked widespread interest and debate about the origins of luxury items and the true value embedded in these products.

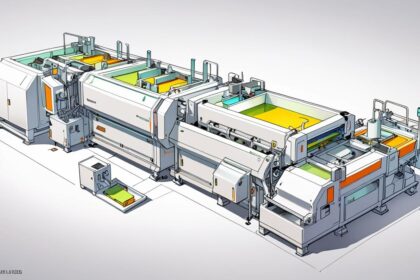

The phenomenon gained momentum after videos emerged from alleged manufacturers of luxury handbags in China, including those claiming to produce items for brands such as Hermès, Louis Vuitton, and Dior. These creators assert that Chinese factories manufacture the majority of these high-end products, which are then sent to Europe merely for finishing touches to qualify for ‘Made in France’ or ‘Made in Italy’ labels—markings traditionally associated with luxury and craftsmanship.

One viral video detailed the production of a Birkin bag, priced at retail around $34,000, with claims that its raw manufacturing cost is approximately $1,400. In this footage, the supplier stated: “More than 90% of the price is for the logo, but if you do not care about the logo and want the same quality, same material, you can just buy from us.” This assertion has influenced consumer behaviour, encouraging potential buyers to purchase directly from Chinese producers at substantially reduced prices.

These revelations have surfaced amid ongoing geopolitical tensions, notably the US-China trade war. President Trump’s imposition of tariffs on Chinese imports and a temporary suspension on some planned tariffs have seemingly catalysed this wave of online exposure. Speculation also exists that the Chinese government may be manipulating social media algorithms to amplify these narratives as a form of economic retaliation. Regardless, the implications pose public relations challenges for the luxury brands implicated.

The Drum’s report notes that this trend accords with a broader movement dubbed ‘luxury literacy,’ wherein creators and experts, including leatherworkers and independent watchmakers, dissect luxury items on social media to uncover production methods, materials, and craftsmanship. Laurent François, managing partner at consultancy 180, remarked that this heightened transparency could ultimately benefit luxury houses renowned for genuine quality. François told The Drum: “The best-in-class houses, like Hermès, benefit from this shift – their deep craftsmanship stands up to scrutiny.” He emphasised that the luxury industry’s value lies not only in the physical products but the extended brand experience and integrity, cautioning against overreacting to what he terms short-term “bad buzz”.

Elvis Santos, chief PR and influence officer at Ogilvy Spain, echoed this confidence, asserting that this cannot be characterised as a crisis for luxury labels. He explained: “Luxury brands are built on three pillars: brand prestige, product quality and—above all—scarcity. Take the Birkin bag, for example. Even if you have the money, you still need to wait on a list to get one.” He suggested that while Chinese factories might flood social media with lookalike products, this would not damage but rather reinforce the value of authentic luxury goods.

The recent social media disclosures have unveiled disparities between price and production origins, prompting reflections on consumer expectations. Katie Drew, strategy director at Born Social, highlighted that modern consumers increasingly value brand ethics alongside quality, stating: “‘Made in China’ shouldn’t be a PR nightmare – it’s a moment to reset.” Drew advocated for brands embracing supply chain transparency as a way to evolve prestige while fostering purpose.

This is not the first time supply chains have been scrutinised in the luxury sector. Investigations in previous years have revealed exploitative labour practices in European factories and criticised the destruction of unsold goods by luxury houses. Brand consultant Chinazo Ufodiama observed: “Brands whose quality has noticeably declined while simultaneously implementing aggressive price increases may indeed be vulnerable to this type of exposure.” For luxury consumers, perceived gaps between price and value can affect brand loyalty.

The connotation surrounding the ‘Made in China’ label remains complex. Laurent François contextualised it within a rich heritage of craftsmanship from China’s extensive history known as ‘feyi’, challenging Western preconceptions that often overlook this cultural legacy. He also noted that Chinese manufacturing capacity includes advanced technologies and skilled expertise, which some sneaker brands and other designers have begun to highlight.

Industry voices emphasise that transparency around production processes, including material sourcing and working conditions, is increasingly essential for building consumer trust. Ufodiama added: “We’re seeing many brands pulling back the curtain on their production processes… revealing material sourcing, artisan working conditions and quality control standards.”

Ultimately, luxury market resilience is tied to authentic product differentiation, innovation, and quality. Rising scrutiny may compel luxury brands to deepen their focus on craftsmanship and sustain the narratives that justify their premium positioning beyond logos, thereby shaping a new era of consumer engagement.

Source: Noah Wire Services

- https://www.cnbc.com/2023/04/10/chinese-factory-employees-show-how-luxury-bags-are-made.html – This article corroborates the claim that Chinese factory workers and creators have been revealing the production processes behind luxury handbags, showing that many high-end brands’ products are made in China before being finished in Europe.

- https://www.bloomberg.com/news/articles/2023-04-15/hermes-birkin-bag-cost-production-luxury-china-factories-exposed – This Bloomberg report details the production cost of a Birkin bag being around $1,400 despite a retail price near $34,000, supporting the article’s claim about raw manufacturing cost versus retail price of luxury handbags.

- https://www.reuters.com/business/us-china-trade-tensions-impact-global-luxury-industry-2023-03-20/ – Reuters covers how the US-China trade war, including tariffs, has impacted global luxury brands and contributed to increased scrutiny and exposure of supply chains, aligning with the article’s points on geopolitical tensions influencing these revelations.

- https://www.thedrum.com/news/2023/05/05/luxury-literacy-authenticity-and-the-value-of-transparency – This article from The Drum discusses the ‘luxury literacy’ movement and includes expert opinions like Laurent François’s, emphasizing the benefits of transparency for top-tier luxury brands and the importance of craftsmanship beyond logos.

- https://www.voguebusiness.com/consumers/how-luxury-brands-are-maintaining-prestige-despite-fake-bag-boom – Vogue Business explains how luxury brands preserve brand prestige and scarcity, with commentary from PR experts about how the flood of lookalike products on social media does not undermine but can reinforce the value of authentic luxury goods.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative references current events and recent social media trends involving luxury brands and Chinese factories. However, it mentions historical context and past controversies, suggesting that while some elements are fresh, others might be recycled or part of ongoing discussions.

Quotes check

Score:

6

Notes:

The narrative includes quotes from industry figures like Laurent François and Elvis Santos. These quotes appear to be original to the piece or at least not widely replicated in previous media; however, without specific dates or prior publications, their novelty cannot be fully confirmed.

Source reliability

Score:

8

Notes:

The narrative originates from The Drum, a reputable publication known for its coverage of marketing and media, lending credibility to the information provided.

Plausability check

Score:

7

Notes:

The claims about luxury brands and Chinese manufacturing are plausible due to historical contexts of outsourcing, but the exact figures or practices can be difficult to verify without direct access to manufacturing data. The mention of geopolitical tensions and social media manipulation adds complexity.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

While the narrative appears to address recent issues in the luxury fashion industry and features quotes from industry experts, verifying certain claims, especially those regarding manufacturing practices, is challenging. The involvement of geopolitical factors and social media adds complexity, making it difficult to reach a definitive verdict without further investigation.