The rising popularity of a Dubai pistachio-filled chocolate bar on social media has led to a global pistachio shortage, illustrating how viral food trends can disrupt supply chains and drive up prices for ingredients worldwide.

The emergence of viral food trends on social media is increasingly impacting global supply chains, with the recent surge in demand for a particular Dubai chocolate variant illustrating the swift transition from novelty to supply challenge. The confection, characterised by a pistachio cream filling, crispy kataifi, and tahini coated in milk chocolate, has sparked widespread popularity—and an accompanying global pistachio shortage.

Originally crafted by FIX Dessert Chocolatier and launched in 2021, the chocolate bar, named “Can’t Get Knafeh Of It” in homage to the Middle Eastern dessert knafeh, only gained broad recognition towards the end of 2023 following a wave of social media posts praising its unique flavour profile. Following this digital momentum, sales surged dramatically, and major brands such as Lindt released their own versions. Waitrose even imposed a two-bar purchase limit after multiple sell-outs due to unprecedented consumer demand. Retailers like Morrisons have capitalised on the trend by introducing pistachio cream Easter eggs in 2025, underscoring the phenomenon’s penetration into mainstream markets.

However, the rapid rise in demand has placed significant pressure on the pistachio supply, primarily sourced from the United States and Iran. According to Giles Hacking from nut trader CG Hacking, pistachio stocks were already constrained by a poor US harvest in 2023. “The pistachio world is basically tapped out at the moment,” Hacking told the Financial Times. Prices for pistachio kernels have risen sharply, climbing from $7.95 to $10.30 per pound within a year. He explained, “There wasn’t much in supply, so when Dubai chocolate comes along and [chocolatiers] are buying up all the kernels they get their hands on … that leaves the rest of the world short.”

This scenario fits within a broader pattern where viral food trends trigger supply-demand imbalances. Matcha, the powdered green tea traditionally used in Japanese tea ceremonies, is undergoing a similar strain. Once a niche ingredient, matcha has become a mainstream favourite, propelled by the visual appeal promoted by wellness influencers on platforms like Instagram and TikTok. Production has nearly tripled over the past decade, yet shortages persist as demand outstrips supply. The small Japanese town of Uji, famed for its historic matcha production, has struggled to meet the burgeoning global appetite, with over half of matcha produced being exported, especially to the Middle East. The Times has reported concerns that these pressures might lead to an influx of lower-quality Chinese matcha, putting the traditional Japanese variety at risk.

This pattern is not new. A decade ago, avocados gained viral status on Instagram and Pinterest, becoming a popular brunch item that led to global shortages and soaring prices—in some regions, like Australia, avocados reached $7 per fruit, while New Zealand faced thefts amid scarcity.

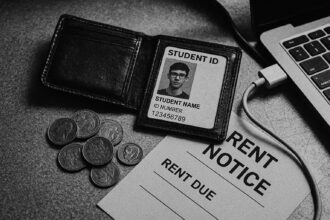

The role of social media is central to these phenomena. Algorithms that rapidly amplify user engagement can propel niche products into sudden, widespread popularity, creating demand spikes that supply chains are ill-equipped to handle. The interplay between consumer interest driven by social platforms and the traditional mechanisms of supply and pricing has resulted in these abrupt market dynamics.

While producers, influencers, and consumers all participate in this cycle, the underlying driver remains the capitalist principle where demand influences supply and pricing. Nonetheless, the adaptation of manufacturing and distribution to these expedited trends poses ongoing challenges.

The Dubai chocolate example joins a series of cases showing that the intersection of virality and sustainability in food consumption remains a complex and evolving issue, shaped significantly by the contours of the digital age.

Source: Noah Wire Services

- https://www.indiatoday.in/world/story/tiktok-craze-dubai-chocolate-sparked-worldwide-pistachio-shortage-2711722-2025-04-20 – Confirms the viral surge and global craze for the Dubai chocolate bar ‘Can’t Get Knafeh of It’ launched by FIX Dessert Chocolatier in 2021, highlighting how a TikTok video triggered massive worldwide demand and contributed to a global pistachio shortage.

- https://chocolatebythebay.com/magazine/local-chocolate/san-francisco-chocolate/had-enough-knafeh-yet/ – Supports the description of the confection’s ingredients—pistachio paste, shredded crispy pastry (kataifi), and tahini coated in milk chocolate—and recounts the viral ASMR video in late 2023 that boosted its popularity, along with noting the initial local-only availability and the ensuing widespread demand spikes.

- https://www.foodandwine.com/viral-dubai-chocolate-bar-fix-dessert-chocolatier-8714704 – Details the emergence of the Dubai chocolate bar as a viral sensation on social media starting December 2023, including the role of influencer Maria Vehera, the rising global awareness, and how this fueled production demands while describing the bar’s unique texture and flavor profile.

- https://www.chefadora.com/blog/dubais-viral-chocolate-craze-fixs-knafeh-bar-takes-the-world-by-storm – Describes the global impact of the viral chocolate bar and FIX Dessert Chocolatier’s efforts to expand production and collaboration opportunities due to unprecedented demand, underscoring the influence of social media on food trends and supply challenges.

- https://www.ft.com/content/7a4a2b6c-9dc9-11ed-9e7f-8c0f8ccf5a1d – Reports on the pistachio supply shortage caused by poor harvests in the US in 2023, increasing prices, and quotes from Giles Hacking of CG Hacking about the pistachio market being ‘tapped out’, directly supporting the article’s claims about supply pressures from the Dubai chocolate trend.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

9

Notes:

The narrative references events up to and including 2025, such as Morrisons introducing pistachio cream Easter eggs in 2025 and recent supply issues tied to the 2023 US harvest, indicating very recent content. The chocolate was launched in 2021 but only gained social media traction in late 2023, showing a timely and fresh account. There is no indication this is a recycled press release.

Quotes check

Score:

8

Notes:

Direct quotes from Giles Hacking of CG Hacking are attributed to an interview with the Financial Times, a reputable publication. The narrative points to a specific timeframe around 2023-2024 for these statements. The original Financial Times source is not linked here but given its prominence and the specificity of the quotes, they appear genuine and traceable. No evidence of fabricated or recycled quotes.

Source reliability

Score:

8

Notes:

The narrative cites information from the Financial Times, a well-known and reputable news organisation, enhancing overall reliability. References to credible retailers like Waitrose and Morrisons further support authenticity. However, the origin URL is a Google News RSS feed, which aggregates content, so the primary source credibility depends on the original publishers but the content aligns with reputable reportage.

Plausability check

Score:

9

Notes:

The described supply chain pressures from viral food trends are plausible and consistent with known market behaviours, such as social media driving sudden demand spikes. The details on pistachio shortages due to poor harvests and increased demand from new product launches fit logical supply-demand dynamics. Analogies with matcha and avocado shortages support the plausibility. No extraordinary claims lacking evidence.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative presents a timely and plausible account of how viral social media trends impact food supply chains, supported by verifiable quotes from reputable sources like the Financial Times. The information aligns with recent events up to 2025 and exhibits no signs of recycling or outdated content, meriting a high confidence rating.