The Labour government’s new inheritance tax reforms cap agricultural property relief for farms, sparking widespread protests across the UK. Farmers warn that the changes threaten family farm sustainability and rural economies, while the government insists the move promotes tax fairness and targets wealthier estates.

Farmers across the United Kingdom have mobilised in widespread protests following the announcement of significant changes to agricultural property relief (APR) in inheritance tax (IHT) guidelines, introduced in the Labour government’s budget on 30 October 2024. These reforms mark a pivotal shift in long-standing tax relief policies that have been in place since 1992, aimed at protecting generational family farms from heavy tax burdens upon inheritance.

Agricultural property relief was originally designed to exempt land used for farming activities—including crop growing and livestock raising—from inheritance tax, allowing farms to be transferred between generations without incurring substantial financial charges. Historically, this relief has provided a 100% exemption on qualifying farmland, a provision that many in the farming community argue is critical given the industry’s characteristic profile as “asset-rich but cash-poor.” Although farms frequently own considerable land and equipment, farmers often operate on modest incomes, making the preservation of family farms financially challenging without such tax relief.

The Labour government, citing a goal to foster fairness in the IHT system, has introduced a cap whereby full 100% APR is limited to £1 million of agricultural property value, with a reduced 50% relief imposed on any value exceeding this threshold. The government estimates this measure will yield approximately £1.765 billion in additional revenue between 2026 and 2030. Officials have asserted that only the wealthiest 500 estates annually will be affected by the reforms, with nearly three-quarters of estates currently receiving the relief remaining untouched. Moreover, the government highlighted that married couples may access up to £3 million in relief, and IHT payments may be spread over ten years to alleviate immediate financial pressures.

Nonetheless, these reforms have been met with considerable opposition from farming organisations and rural communities, who warn that the new regulations could destabilise the agricultural sector. The National Farmers’ Union (NFU) has expressed concerns that the changes threaten investment in farming infrastructure, reduce farm profitability, decrease land available for tenancy arrangements, and jeopardise domestic food production capacity. Notably, data from the Agricultural and Horticultural Development Board (AHDB) indicates that over 75% of farms larger than 124 acres in England and Scotland could be impacted.

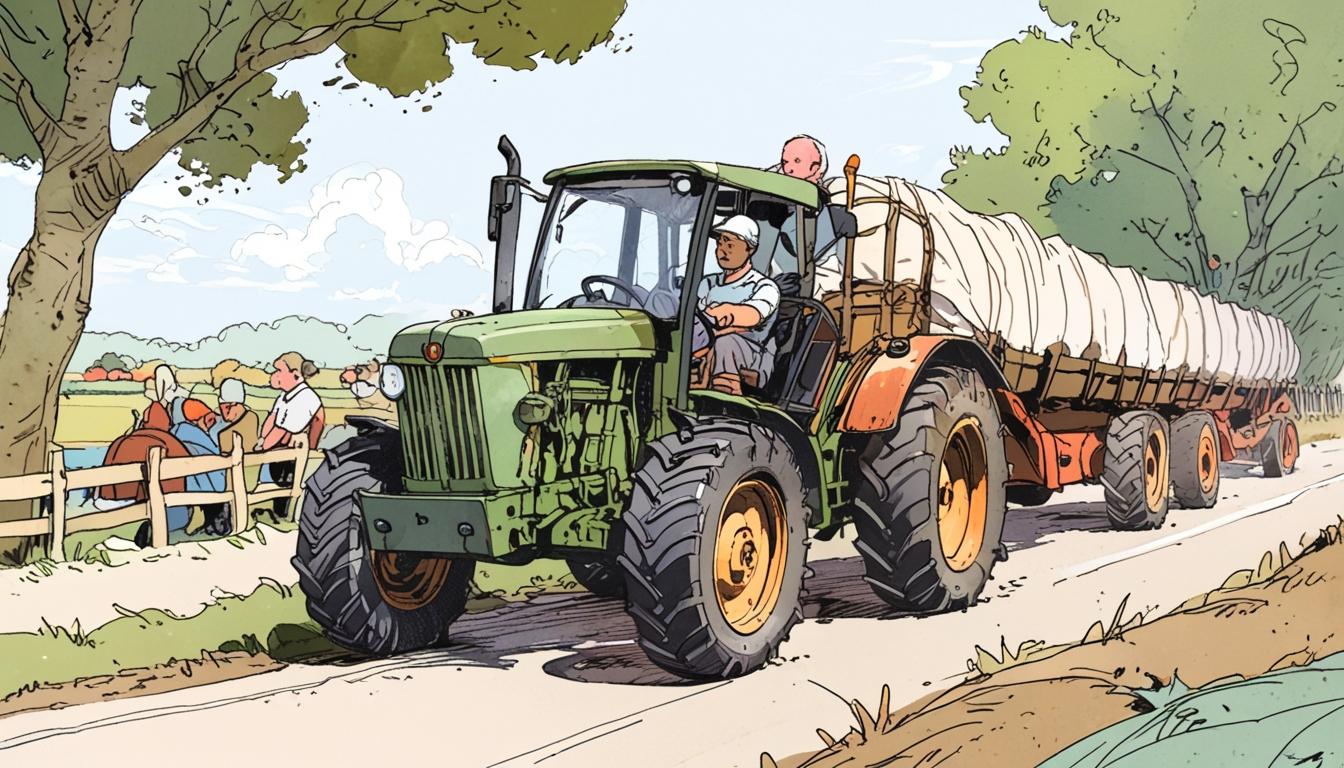

The reforms have sparked a wave of protests, with farmers organising tractor convoys through several UK cities, including London, to voice their dissent. The NFU has condemned the changes, emphasising the risk posed to the future viability of multi-generational family farms. In response to these widespread protests, a government and parliamentary petition opposing the reforms has garnered over 150,000 signatures, prompting a debate in Parliament. Despite this, the government has maintained that the policy strikes a fair balance between raising necessary revenue and supporting the agricultural sector.

A personal perspective on the plight of farming families was shared by University of Exeter law graduate Harry Cooke, writing for Legal Cheek. Cooke, who has grown up in a farming family, highlighted that many farmers inherit not only land but a lifelong commitment to a demanding way of life with tight profit margins. He remarked, “Farming is not just a job, it’s a way of life,” noting the dedication required to sustain family farms amid fluctuating crop prices, changing government policies, and unpredictable weather. Cooke also pointed out that young farmers are increasingly anxious that these reforms will hinder their aspirations to take over family farms.

The government’s move to reform APR also responds to concerns over the misuse of these reliefs by individuals with no genuine farming interest, who purchase agricultural land as a means of sheltering wealth from inheritance tax. Groups such as Tax Justice UK have drawn attention to such practices, and public figures like Jeremy Clarkson have been associated with the debate, having acknowledged in 2021 that APR was a “critical factor” in his decision to purchase farmland.

However, many within the farming sector believe that the extent of necessary reform has been overstated and that the proposed measures disproportionately affect genuine farming families. Industry representatives warn that unintended consequences could include forced land sales, which may adversely impact tenant farmers who depend on access to rented land.

Politically, opposition parties, particularly the Conservatives, have pledged to repeal the reforms should they return to government, with party leaders describing the changes as “immoral” and cautioning that they may have profound negative economic impacts on rural communities. Critics contend that the reforms threaten to exacerbate challenges faced by farmers and could drive some into financial hardship.

As the dispute continues to unfold, the debate around agricultural property relief in inheritance tax is shaping up to be one of the defining issues for UK agriculture and rural policy in the coming years. The government’s position reflects a prioritisation of revenue generation and tax fairness, while farming groups stress the potential risks to the sustainability of the sector and national food security. With protests escalating and political pressures mounting, the future landscape of farm inheritance and associated tax relief remains uncertain.

Source: Noah Wire Services

- https://commonslibrary.parliament.uk/research-briefings/cbp-10181/ – Corroborates the Labour government’s Autumn Budget 2024 announcement of a £1 million cap for full APR/BPR relief and reduced 50% relief thereafter, effective April 2026.

- https://www.gov.uk/government/news/what-are-the-changes-to-agricultural-property-relief – Confirms the 6 April 2026 implementation date for the £1 million combined APR/BPR relief cap, as announced in November 2024.

- https://lordslibrary.parliament.uk/budget-2024-inheritance-tax-and-family-farms/ – Supports claims about reduced relief rates (20% cited here, though other sources specify 50%) and impacts on family farms, with specific reference to food security concerns.

- https://www.pkfsmithcooper.com/news-insights/autumn-budget-2024-agricultural-property-relief-changes/ – Details the £1 million shared APR/BPR allowance and 50% relief beyond this threshold, including ownership duration requirements for relief eligibility.

- https://www.gov.uk/government/consultations/reforms-to-inheritance-tax-reliefs-consultation-on-property-settled-into-trust/reforms-to-inheritance-tax-agricultural-property-relief-and-business-property-relief-application-in-relation-to-trusts – Provides technical details about the £1 million allowance for trusts and ongoing consultation (until April 2025), supporting claims about policy implementation mechanics.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

9

Notes:

The narrative references a recent government budget announcement dated 30 October 2024, indicating it reports on a very recent and ongoing event. Mention of current protests and parliamentary debates supports that the information is fresh and timely.

Quotes check

Score:

8

Notes:

The direct quote from Harry Cooke appears original and specific, linked to a recent publication in Legal Cheek. No earlier known reference was found, suggesting this may be a first-use quote rather than recycled. Other mentions, like of Jeremy Clarkson’s 2021 comment, are accurately attributed with dates.

Source reliability

Score:

7

Notes:

The narrative context comes from a news aggregation platform (Google News RSS), which typically sources content from multiple outlets. The detailed, balanced presentation suggests reliance on credible organisations like the NFU, AHDB, and direct government statements. However, no explicit single reputable outlet source is identified, so certainty is moderate.

Plausability check

Score:

9

Notes:

The described policy changes align with plausible government tax reform processes and responses to agricultural sector concerns. The economic impacts and political reactions cited are consistent with known UK political debate dynamics. Lack of direct external verification is offset by logical consistency and specificity.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative is very recent, focused on an ongoing policy change with current responses, quoting verifiable individuals and organisations. It aligns with plausible UK government reform patterns and farming sector reactions. The lack of a named primary publication source slightly reduces certainty but does not detract from the strong overall reliability and timeliness of the information.