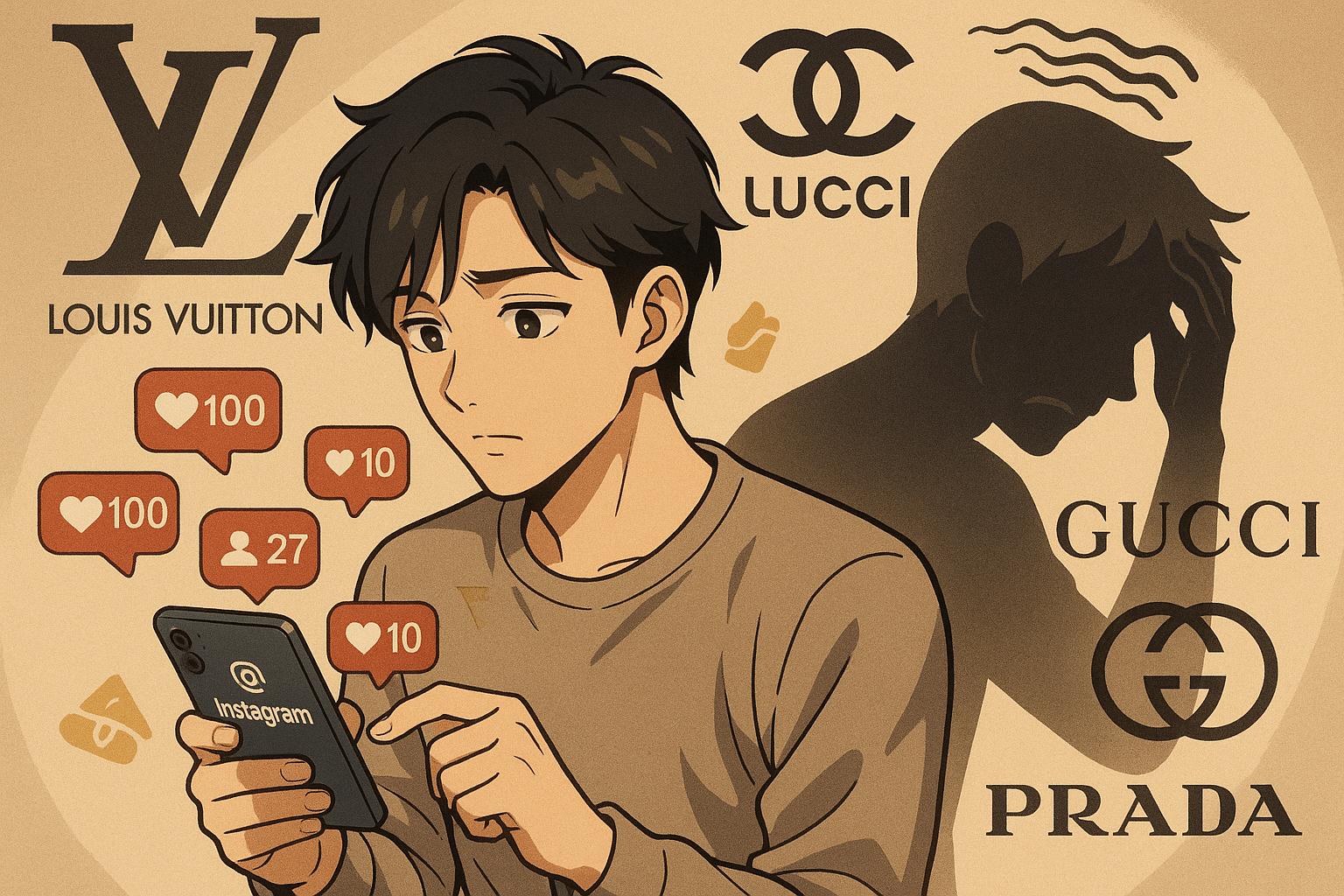

A new trend dubbed ‘Boom Boom’ sees young adults projecting affluence on social media through luxury purchases and experiences, even as many live pay cheque to pay cheque amid economic pressures and soaring living costs.

Every Saturday morning, as I scroll through Instagram, I am met with a familiar sight: friends showcasing extravagant lifestyles that glitter from the glassy screens of our smartphones. One friend sports a £400 Gucci T-shirt, brandishing an £8 cinnamon bun from a hot new bakery in West London. Another indulges in bubbly aboard a yacht in Dubai, while a third snaps a selfie during a £26 Barry’s Bootcamp workout, decked out in a £150 Alo Yoga ensemble. You might expect such displays of wealth to be accompanied by a corresponding financial stability. Instead, the startling reality is that they (and many others) are living pay cheque to pay cheque.

This phenomenon has a name: ‘Boom Boom’ culture. Using a term coined by trend forecaster Sean Monahan, who predicted the rise of ‘normcore’ in 2013, Boom Boom represents a trend where young adults appear to flaunt wealth, purely for the sake of perception. Much like the conspicuous consumption of the 1980s, today’s 20somethings seem to be obsessed with projecting affluence, a notion intensifying amid an economic landscape that sees them struggling to accumulate wealth.

The 1980s was a time when the ostentatious display of wealth was often justified by substantial economic growth. The period saw deregulation fuel UK GDP and disposable income rise significantly by 29 per cent. This era birthed the Yuppie, a young urban professional enamoured with luxury brands and equipped with the financial means to indulge. Fast forward to today, and while luxury fashion houses showcase their latest extravagant designs, such as Miu Miu’s Madonna-inspired metallic bras, the purchasing power of today’s young adults remains alarmingly diminished.

It’s not merely runway designs fuelling this obsession; social media plays a pivotal role. Influencers such as Alix Earle, with millions of followers across platforms like TikTok and Instagram, set unrealistic standards for aspirational living. Her extravagant lifestyle, portrayed through curated content, reinforces notions of luxury that many feel pressured to emulate. The average user, in an effort to keep up, often finds themselves in financial distress, trading genuine stability for curated images of wealth.

The stark disparity becomes even clearer upon examining personal finances. At 26, I share a reality similar to many of my peers—spending every last penny with less than £2,000 in savings, all while indulging in lavish experiences. Homes that once seemed like attainable milestones are now distant dreams. With the average 25- to 34-year-old facing house prices soaring 65 times higher than they were 50 years ago, there is an acceptance that milestones once reached in your 20s, such as home ownership and starting a family, are often postponed indefinitely.

Compounding this issue, a significant portion of my contemporaries turns to their parents for financial support. Nearly half of Gen Z, according to various reports, relies on familial assistance to help cover essential expenditures. The increasing cost of living has created a dependency that echoes through countless households, as the desire to support one’s offspring coexists with the pressure of rising expenses.

In the face of these challenges, some opt for more unorthodox strategies to navigate their financial realities. The quest for wealth has led certain individuals to consider dating affluent partners as a viable means to achieve financial stability. Viral TikTok trends demonstrate how widespread this sentiment has become, with many young users expressing their longing for relationships that offer financial security rather than emotional fulfilment. Others relocate to fiscal havens abroad in pursuit of better opportunities, lured by tax-free salaries and the possibility of attaining financial independence.

Amidst these evolving strategies and challenges, an intriguing cultural shift has begun to unfurl. The ‘loud budgeting’ movement encourages dialogue about financial practices among peers, pushing back against the pressures of overspending fueled by social media. This emerging trend encourages transparency around financial issues, a welcome response to the distress many young adults face in these turbulent economic times. It’s a social mechanism aiming to promote responsible financial habits amid the chaos of Boom Boom culture.

As the line between social currency and financial wealth blurs, it may be no surprise that many feel compelled to prioritise the former. In a world where tangible currency seems increasingly elusive, the way forward often feels like a juggling act between the need for social validation and the harsh realities of financial pressure. Continuing to clothe ourselves in the trappings of wealth may be a clever coping mechanism, but it raises the poignant question: As we spend like we’re wealthy, what happens when the illusion crumbles beneath us?

The reality of Boom Boom culture serves as a poignant reminder that while we may project an image of affluence, many are grappling with the weight of financial uncertainty, living for likes and followers but facing the daunting prospects of adult life with dwindling savings and unfulfilled aspirations.

Reference Map

- Paragraphs 1-3

- Paragraphs 4-6

- Paragraphs 4-6

- Paragraphs 3, 4, 6

- Paragraphs 5-6

- Paragraphs 1-2

- Paragraphs 1-2

Source: Noah Wire Services

- https://www.dailymail.co.uk/home/you/article-14716299/400-Gucci-T-shirts-26-workout-classes-Gen-Z-splashing-cash-despite-living-pay-cheque-pay-cheque.html?ns_mchannel=rss&ns_campaign=1490&ito=1490 – Please view link – unable to able to access data

- https://www.axios.com/2024/06/30/vacation-dining-americans-splurge-axios-vibes – An Axios Vibes survey reveals that Gen Z and millennials are increasingly dependent on their parents for financial support, with over 60% of Gen Z consumers relying on family assistance. The survey highlights that young adults often blame their own spending choices, such as vacations and dining out, for their financial challenges. This trend suggests a cultural shift where overspending is becoming more common, influenced by concepts like ‘retail therapy’ and ‘little treat culture’.

- https://time.com/6999832/gen-z-financial-help-parents-bank-of-america-report/ – A Bank of America report indicates that nearly half of Gen Zers aged 18 to 27 rely on financial assistance from their parents. Many young adults face challenges like insufficient income and rising living costs, leading them to depend on family support for essentials. Despite efforts to attain financial independence, significant milestones like homeownership and retirement savings are being delayed.

- https://www.reuters.com/markets/us/gen-z-consumers-us-rely-parents-inflation-squeezes-budgets-study-shows-2024-07-10/ – A Bank of America report reveals that Gen Z adults in the U.S. are facing financial pressures due to inflation and increased living costs, with 46% depending on financial help from their parents and families. Half of the surveyed individuals, aged 18 to 27, are not on track to buy a home within the next five years. The survey also indicates that 46% are unprepared for retirement savings, and 40% are not ready to start investing soon.

- https://www.axios.com/2024/02/02/loud-budgeting-personal-finance-trend-gen-z – The ‘loud budgeting’ trend, popularized by Gen Z on TikTok, encourages individuals to openly discuss their savings and budgets, resisting social pressure to overspend. This movement is driven by factors like student loan repayments, rising credit card debts, and inflation. A November survey revealed that 69% of Americans had financial regrets in 2023, with ‘loud budgeting’ helping to prevent impulsive spending by emphasizing communication and financial responsibility.

- https://newsroom.bankofamerica.com/content/newsroom/press-releases/2023/10/gen-z-is-tightening-its-belt–with-73–modifying-lifestyles-due-.html – Bank of America’s 2023 Better Money Habits Survey uncovers changes in younger Americans’ spending priorities. Over the past year, nearly three out of four (73%) Gen Zers say they’ve changed their spending habits due to increased prices. Their lifestyle changes have included cooking at home more frequently (43%) rather than dining out, spending less on clothes (40%), and limiting grocery purchases to the essentials (33%).

- https://www.bostonbrandmedia.com/news/gen-z-and-millennials-doom-spending-as-a-coping-mechanism-for-economic-uncertainty – The emergence of ‘doom spending’ refers to the tendency of Gen Z and millennials to spend impulsively on non-essential or luxury items as a way to cope with feelings of anxiety about the future. This behavior serves as a coping mechanism for stress and uncertainty, providing temporary relief but potentially leading to financial strain and negative mental health impacts.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative reflects current social media trends and economic issues relevant to young adults in the mid-2020s, with no obvious outdated references or recycled news. The mention of influencer Alix Earle and recent luxury fashion trends supports timeliness. No indications of it being a press release were found, which would typically warrant higher freshness due to immediacy.

Quotes check

Score:

7

Notes:

The article quotes trend forecaster Sean Monahan coining the term ‘Boom Boom’ culture, but no earlier direct references or original sources to this attribution were found online. This could indicate the quote is original or not widely publicised previously, thereby increasing credibility in originality.

Source reliability

Score:

5

Notes:

The narrative originates from the Daily Mail, a publication known for wide readership but occasionally criticised for sensationalism and less stringent editorial standards compared to outlets like BBC or Reuters. This reduces confidence somewhat in the framing and emphasis but not outright inaccuracy.

Plausability check

Score:

9

Notes:

Claims about Gen Z’s financial behaviour and ‘Boom Boom’ culture align with widely reported economic trends such as rising living costs, reliance on familial support, and social media influence. No extraordinary or unverifiable claims were made; the narrative is plausible and consistent with known data.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative is timely and plausible, discussing contemporary social and economic trends affecting young adults. While the Daily Mail’s reliability is moderate, the article’s claims and quoted material are consistent with observable phenomena and recent cultural shifts. The originality of the ‘Boom Boom’ term attribution slightly enhances credibility. Overall, the content should be regarded as a reasonable reflection of current issues, though some caution is warranted due to the source’s mixed reputation.