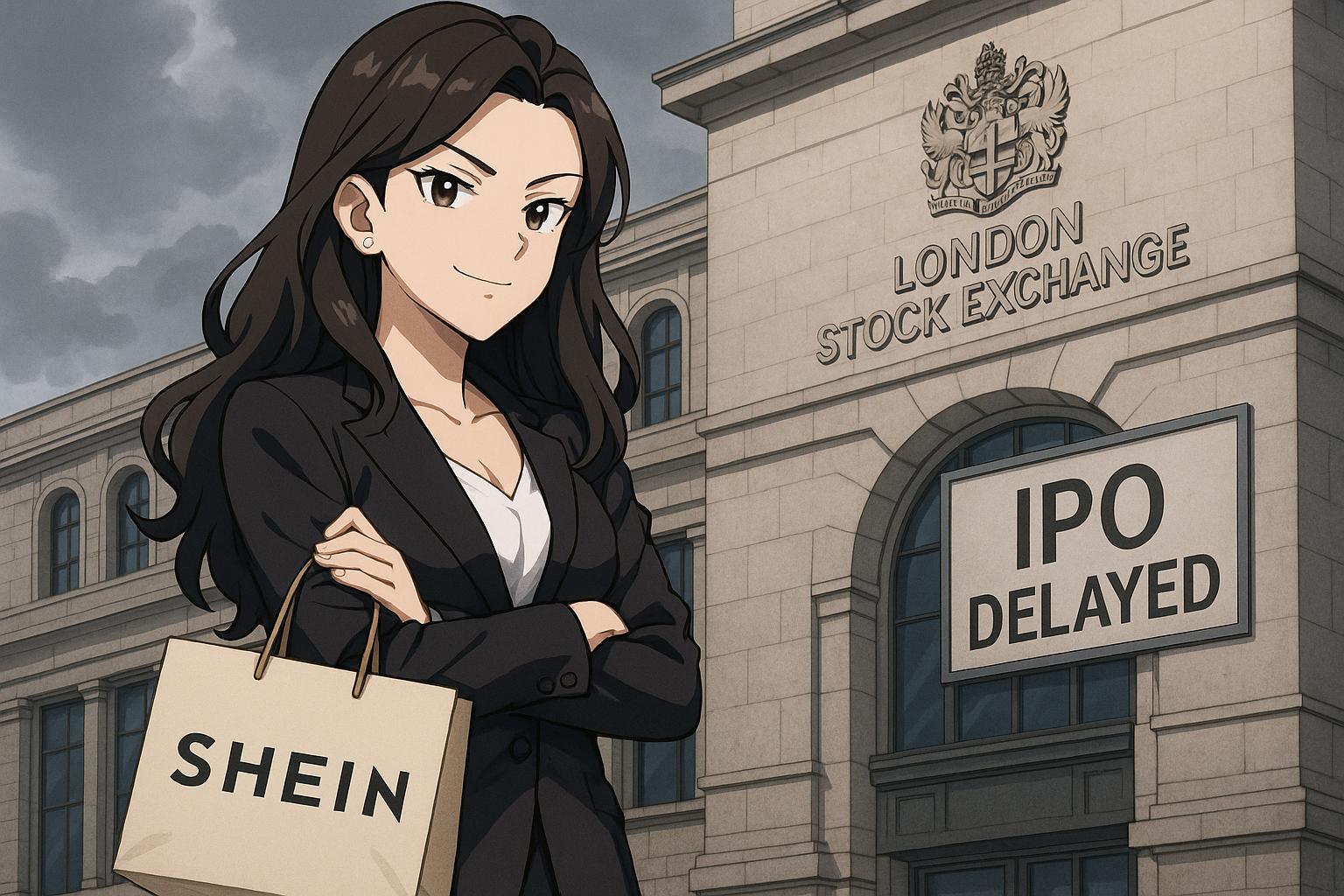

Shein has postponed its London IPO until autumn due to pending Chinese regulatory approval and broader UK market challenges, reflecting wider caution among firms amid tariff-driven volatility and economic uncertainty.

Shein, the fast-fashion giant, has postponed its much-anticipated initial public offering (IPO) on the London Stock Exchange until the autumn, as indicated by sources close to the company. Originally intended for the first half of this year, the IPO received approval from the UK’s Financial Conduct Authority last month. However, it awaits crucial sign-off from Chinese regulators, where Shein was established. The company has chosen not to comment on its future listing plans.

This delay is emblematic of a broader trend among UK businesses. The current landscape of tariff-induced market volatility has resulted in numerous companies reassessing their public offering timelines. In the first quarter of this year, only five new IPOs emerged, marking a staggering 74% decrease compared to the previous year. Many firms are grappling with uncertain economic conditions, further complicating the path to a successful listing.

The UK government has been actively encouraging homegrown businesses to consider domestic listings. Recently, City minister discussions with chief executives from several fintech unicorns, including Monzo, OakNorth, ClearScore, and Revolut, highlighted this initiative. The aim is to fortify the London market and retain British companies as national assets. Yet, not all recent discussions have yielded a favourable outlook for UK listings. Verisure, a provider of home alarm systems, is reportedly favouring Amsterdam for its IPO, while an adviser to Revolut conveyed a strong likelihood that the fintech would pursue a listing in the US. Nikolay Storonsky, Revolut’s CEO, previously voiced concerns about a UK listing, deeming it “not rational” due to issues of market liquidity and the burden of stamp duty.

In the midst of this uncertainty, there remains cautious optimism regarding the future of IPOs. As one adviser noted, the interest in transitioning from private capital to public companies is not extinguished, with a potential upturn projected ahead of 2026. The adviser elaborated, “It was about to hit when Trump messed around with tariffs. It’s challenging to float companies when the markets are this volatile, and pricing is unclear.” This sentiment underscores a prevailing belief that while the current environment poses significant hurdles, the IPO pipeline could eventually witness a renaissance as economic conditions stabilise.

As Shein navigates its complex regulatory landscape and other firms reassess their strategies, the interplay between domestic aspirations and global market dynamics remains deeply significant. While the immediate future presents challenges, the anticipated shift towards an active IPO market in the coming years may pave the way for a resurgence of public offerings in the UK.

Reference Map:

Source: Noah Wire Services

- https://observer.co.uk/news/business/article/fast-fashion-firm-shein-to-delay-listing-as-tax-free-loophole-is-closed – Please view link – unable to able to access data

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative discusses recent events and current market conditions, suggesting a relatively fresh perspective. However, there is no specific date mentioned in the text, which might indicate it is not the latest update.

Quotes check

Score:

7

Notes:

The quote from the adviser regarding Trump and tariffs does not have a clear original source. The mention of Nikolay Storonsky’s concerns about UK listings lacks specific sourcing but is consistent with known concerns about market conditions.

Source reliability

Score:

6

Notes:

The narrative originates from the Observer, which is generally a reliable news outlet. However, the lack of specific named sources for some quotes reduces reliability slightly.

Plausability check

Score:

9

Notes:

The claims about Shein’s IPO delay and the broader economic context are plausible, given the current market volatility and regulatory changes.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative is generally plausible and recent, but the absence of specific dates and the reliance on unnamed sources for some quotes reduce the confidence level.