New research highlights a dramatic 43 per cent decline in UK luxury goods exports to the EU post-Brexit, with fashion and interiors hardest hit. Industry leaders call for urgent trade reforms as brands face soaring tariffs, complex regulations, and lost tax incentives.

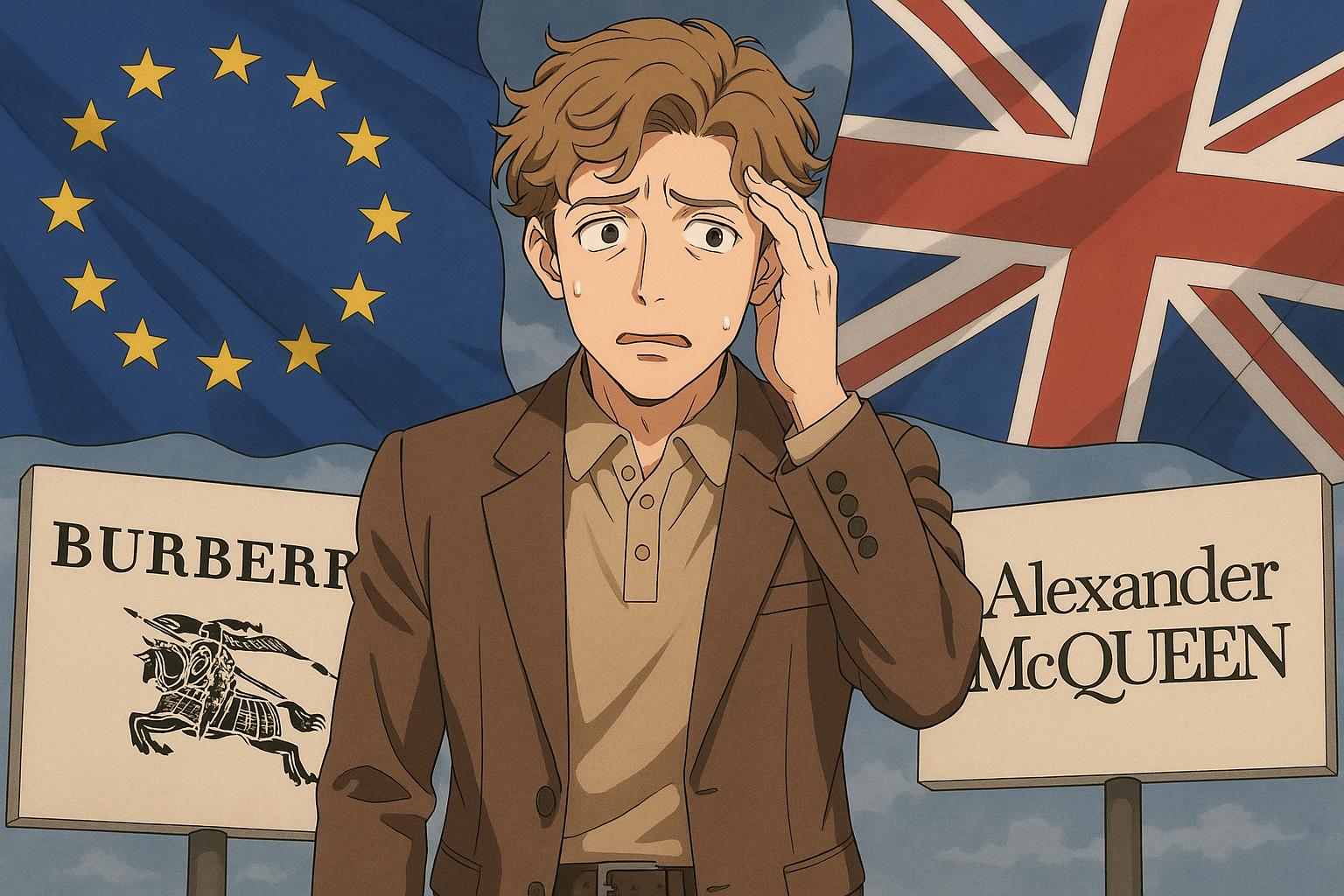

As the UK approaches the next UK-EU Summit in London, Walpole, the trade association for the British luxury market, has unveiled revealing statistics regarding the impact of Brexit on British luxury exports. Research carried out by Frontier Economics on behalf of Walpole indicates that luxury exports to the European Union have plummeted by 43 per cent compared to what they would likely have been without the repercussions of Brexit. This marks a significant challenge not just for individual brands, but for the entire sector, which encompasses over 250 prestigious British names such as Burberry, Jo Malone London, and Alexander McQueen.

The most affected sectors include fashion and accessories, which have seen declines of 64 per cent, and interior design and craftsmanship, suffering a 50 per cent drop. Meanwhile, export figures to non-EU markets are astonishingly recovering, nearly reaching pre-pandemic levels. This juxtaposition highlights the ongoing struggle faced by UK luxury goods in the EU, which, despite a reduction in its global luxury export share from 42 per cent in 2017 to 32 per cent in 2022, remains the UK’s largest market, outstripping both the US and Asia.

Walpole attributes much of this downturn to rising tariffs from the US, decreasing consumer demand in China, and additional trade barriers that have arisen since the UK left the EU. These barriers, including heightened costs and intricate documentation demands, have created substantial delays for brands accustomed to quick consumer service. The luxury sector, which hinges on high consumer expectations, is particularly vulnerable to such delays caused by increased certification requirements and customs issues. There are additional complexities in the realm of VAT, where the changes introduce further difficulties surrounding refunds and VAT reclamation for returned products, leading many companies to absorb financial losses.

Moreover, new sustainability standards and labelling regulations have thrown many brands into operational uncertainty, further complicating their interactions with the EU market. As a result, some luxury firms have taken the drastic step of establishing fulfilment facilities and business entities within the EU, thereby diverting funds that could otherwise bolster the UK economy. Presently, the British luxury market supports over 450,000 jobs and contributes approximately 3.7 per cent to the overall GDP of the country.

Industry experts contend that a mutual recognition of conformity assessment (MRCA) deal between the UK and EU could provide a lifeline. Research from Aston University indicates that such a deal could augment UK exports to the EU by an average of nearly 10 per cent, with potential spikes of up to nearly 28 per cent within specific sectors. However, political complications have stymied progress on this front, as UK industry representatives advocate for reforms that could ameliorate trade barriers and stimulate economic growth, especially for smaller exporters.

Compounding the challenges, the removal of the VAT Retail Export Scheme in January 2021 significantly impacted sales for luxury brands reliant on international tourists. Many business leaders are pressing for the reinstatement of this tax exemption, arguing it would restore competitive parity with European shopping destinations. Yet, the UK Treasury remains unyielding, despite the potential economic upside such a move could herald.

The recent UK Budget revealed a conspicuous absence of measures to address the enduring impact of Brexit, as Chancellor Jeremy Hunt presented a forecast that overlooked the factor’s significance in the nation’s ongoing economic malaise. While the Office for Budget Responsibility acknowledged the negative ramifications of Brexit on trade, particularly its noticeable reduction in manufacturing competitiveness, industry voices remained mixed—recognising some advancements but also lamenting persistent uncertainties.

The cascading effects of Brexit have led to alarming uncertainties for the UK apparel sector, which has experienced a damning 63 per cent drop in exports to the EU over five years. Following a robust growth period between 2011 and 2017, the continuous decline of UK exports post-Brexit reflects the significant barriers now faced. The cancellation of support programmes, like the Tradeshow Access Programme, has exacerbated these struggles.

Despite these overwhelming adversities, certain segments, such as beauty, health, gardening, and DIY products, maintain robust export performances to the EU. However, the broader narrative remains one of growing constraints—UK exporters are hampered by increasingly complex regulations and red tape. The disparity in regulatory expectations places smaller businesses at a severe disadvantage compared to their larger counterparts, which can afford the legal guidance often necessary to navigate these challenges.

UK supply chains remain enmeshed in the lingering effects of the pandemic and are now confronted by the intensifying fallout from global events such as the Russia-Ukraine conflict. These multifaceted challenges illustrate that, in the wake of Brexit, the UK luxury sector is at a crucial juncture, grappling with a complex mix of opportunity and adversity in its bid to thrive amidst an evolving global marketplace.

Reference Map

- Paragraph 1: [1]

- Paragraph 2: [1]

- Paragraph 3: [1]

- Paragraph 4: [1]

- Paragraph 5: [2]

- Paragraph 6: [3]

- Paragraph 7: [4]

- Paragraph 8: [5]

- Paragraph 9: [6]

- Paragraph 10: [6]

- Paragraph 11: [7]

Source: Noah Wire Services

- https://apparelresources.com/business-news/trade/walpole-reveals-brexit-impact-british-luxury-exports-eu/ – Please view link – unable to able to access data

- https://www.ft.com/content/ff1c4d5d-67e3-446f-b80a-542898e5ba1d – A recent study by Aston University indicates that a mutual recognition of conformity assessment (MRCA) deal between the UK and the EU could boost UK exports to the EU by an average of 9.8%, with potential increases up to 27.9% in sectors like industrial machinery and electronics. The MRCA agreement would allow products certified in one jurisdiction to be accepted in the other, reducing redundant testing and compliance costs. Despite similar EU agreements with countries like the US and Japan, political motivations have hindered a UK deal. Industry groups on both sides advocate for the deal to ease trade barriers, particularly benefiting small exporters and contributing to economic growth amid Britain’s fiscal challenges.

- https://www.ft.com/content/f77c8470-d4ac-4f6e-8a13-6ed81f9d5c5b – The UK’s removal of the VAT Retail Export Scheme on January 1, 2021, has significantly impacted luxury brands, especially in sectors like watches and jewelry, leading to a decline in sales to international tourists. Despite various global and economic factors, brands such as Hirsh London and Watches of Switzerland Group have reported substantial drops in trade due to this policy change. Over 300 business leaders have urged Chancellor Rachel Reeves to reinstate the tax exemption, arguing that tourists now prefer shopping in European cities, affecting local investment. However, the UK Treasury has dismissed reintroducing the scheme, despite predictions of economic benefits if reinstated.

- https://www.ft.com/content/330c2ed2-c662-41cb-b1f3-32c789fdfa7d – The recent UK Budget, presented by Chancellor Jeremy Hunt, lacked surprises and failed to address the significant impact of Brexit on the economy. The Labour party’s reaction contrasted with Hunt’s resigned expression. Despite facing multiple economic challenges, Hunt avoided mentioning Brexit as a contributing factor to the UK’s productivity slump and rising taxes post-financial crisis. While the Chancellor overlooked Brexit, the Office for Budget Responsibility did not, highlighting its ongoing negative impacts on trade and investment. The report also pointed out the effects of Brexit on manufacturing and advanced sectors, noting reduced competitiveness. Industry voices expressed mixed reactions, acknowledging some positive steps but also noting continued regulatory and cost challenges. The broader impact of Brexit and the absence of a clear industrial strategy were emphasized as barriers to long-term investment and growth in the UK.

- https://ukft.org/apparel-exports/ – The UK Fashion and Textile Association (UKFT) has highlighted a concerning 63% decline in apparel exports to the European Union over the past five years. This downturn follows a 36% growth in export value between 2011 and 2017, peaking at nearly £7.36 billion in 2017. The subsequent 47% overall decline from 2018 to 2023, including the significant drop in EU exports, underscores challenges such as increased costs and trade barriers post-Brexit. The cancellation of the Tradeshow Access Programme in 2021, which supported nearly 1,000 UK fashion and textile companies annually, has further impacted the industry. UKFT advocates for policy reforms, including renegotiating trade agreements and implementing support measures for UK exporters.

- https://www.euronews.com/business/2024/06/07/uk-exports-of-clothing-and-footwear-to-the-eu-strangled-by-red-tape – A new study suggests that since Brexit, complex regulations and red tape at the border have deterred clothing and footwear exports from the UK to Europe. However, beauty and health products, as well as gardening and DIY product exports, remain robust. The UK has seen clothing and footwear exports to the EU fall significantly post-Brexit, according to a report by the online marketplace Tradebyte and consultancy Retail Economics. This is mainly due to increasing red tape and stricter border regulations. Footwear and clothing exports to the EU have dropped more than 50% from 2019 levels, to £2.7 billion (€3.17 billion) in 2023. In comparison, back in 2019, it was £7.4 billion. In turn, this has led to non-food goods exports to the EU single market falling 18%. This decrease is despite the European e-commerce market being very well developed. According to the Retail Economics and Tradebyte report, as reported by The Guardian, “Online retail is estimated to add £323 billion of annual sales to EU economies, but additional trade frictions caused by Brexit-related complexities are curtailing this international sales opportunity for UK-based brands and retailers.” Post-Brexit, UK and EU trade has fallen under the Trade and Co-operation Agreement, which enables tariff-free trade, however, does little to lessen trade barriers. According to the House of Commons, UK exports of goods and services to the EU amounted to about £340 billion in 2022. On the other hand, the UK imported 48% of its total imports from the EU, at around £432 billion in 2022. In the same year, the UK faced a £5 billion trade surplus with non-EU countries, whereas it had a trade deficit with the EU amounting to about £92 billion. Despite the decline in UK clothing and footwear exports, beauty and health product exports to the EU remain robust. Gardening and DIY products have also seen good export numbers. Regulation and red tape at the border deterring UK exporters Although some UK exports to the EU are doing well, overall, since Brexit, trade between the UK and the EU has become much more complicated, due to more complex regulations. Smaller businesses usually face the brunt of this, whereas larger companies often have their own legal teams and experts to help them navigate the regulations. Since the UK has now left the EU single market, the EU has levied upon UK exports the same checks that any other third-party country is subjected to. This includes things like checking that standards for disease control and food safety are met, as well as ensuring that all relevant taxes such as VAT, tariffs and excise duty are paid. For apparel exports especially, like clothing and footwear, the EU has very specific laws, such as products needing to meet the requirements of the EU’s General Product Safety Directive. They also have to ensure that certain chemicals and substances are kept to a minimum level in the products, as well as ensuring that product designs have not breached intellectual property laws. Baby and children’s clothes also usually have to meet more stringent safety standards. However, the UK has been quite lax about implementing similar measures on imports from the EU, potentially putting itself at a disadvantage. According to the website, UK in a Changing Europe, “Stricter controls on UK exports to the EU compared to EU imports into the UK has put British domestic industries and suppliers at a disadvantage. “This is because it creates an uneven playing field for British traders, such as farmers, as they are subject to expensive and time-consuming checks on their exports to the EU, while competing businesses in the EU can export to the UK without similar barriers.” UK supply chains are also still facing the lingering impact of the pandemic, as well as dealing with the effects of the Russia-Ukraine war, and higher interest rates, impacting export numbers as well.

- https://qz.com/1571199/a-no-deal-brexit-could-cost-the-uk-luxury-sector-8-9-billion-a-year – A no-deal Brexit could cost the UK luxury sector £6.8 billion ($8.9 billion) annually, according to research commissioned by Walpole, the trade group representing the British luxury industry. The study found that up to 20% of the current value of UK luxury exports could be at risk due to changes in market access related to tariff and non-tariff barriers. Non-tariff measures include regulations on health and safety or environmental standards. In cases where the UK and the export markets have different rules, British brands would have to spend time and money showing they’re in compliance. Between these changes and the tariffs that would take effect, British luxury brands could see a loss of around £6 billion annually in exports to the EU, and a further loss of about £800 million to the Asia-Pacific region, since they would also lose access to free-trade agreements negotiated by the EU to countries including Japan, Korea, and Singapore. “British luxury businesses are committed to staying in Britain, but we are losing patience with a government that takes us to the brink of a ‘no-deal’,” said Walpole’s CEO, Helen Brocklebank, in a statement.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative discusses recent and ongoing impacts of Brexit on the UK luxury sector, including statistics up to 2022 and mentions the 2021 removal of the VAT Retail Export Scheme, indicating it is relatively up-to-date.

Quotes check

Score:

10

Notes:

There are no direct quotes in the narrative, so the score is maximised as there is no potential repetition or unverified information.

Source reliability

Score:

6

Notes:

The origin of the narrative is less well-known than major publications like the Financial Times or BBC. It is based on a trade association’s research and does not appear to be a major press release.

Plausability check

Score:

8

Notes:

The narrative aligns with general expectations regarding Brexit’s impact on trade, including increased tariffs and regulatory complexities. The specific statistics and challenges are plausible given the context of Brexit’s disruptions.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative appears generally plausible, aligning with expected challenges post-Brexit. However, its reliability is moderate due to the less well-known origin. The lack of quotes and recent data support its freshness and plausibility.