A new Minimum Income Standard for Students analysis finds first‑year students in England need about £418 a week (roughly £21,100 a year) but the 2025/26 full‑rate maintenance loan outside London is capped at £10,544, covering only around half of costs. Researchers warn the gap — which can total about £61,000 over a three‑year degree (£77,000 in London) — forces excessive paid work, increases reliance on high‑cost borrowing and risks worsening access and student wellbeing, and call for redesign of maintenance support including London weighting and clearer rules on imputed parental contributions.

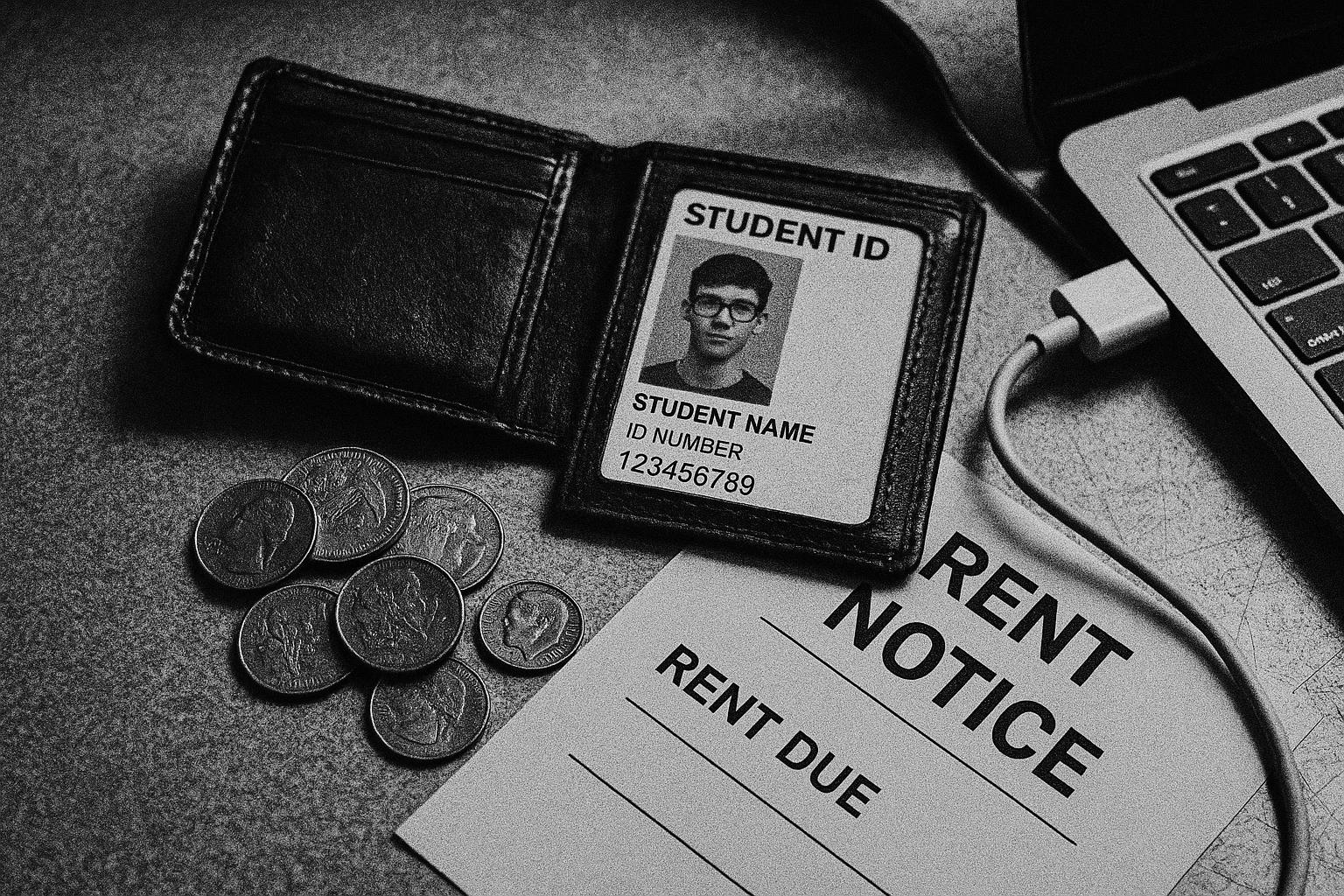

A new analysis of student living costs has laid bare the widening gap between state support and the money required for a minimum, socially acceptable standard of living while studying. The report finds that first‑year students in England need on average £418 a week when rent is included — equivalent to roughly £21,100 a year outside London — yet the full‑rate maintenance loan for 2025/26 for those living away from home and studying outside London is capped at £10,544. According to the researchers, that loan therefore covers only about half of a fresher’s living costs; over the course of a typical three‑year degree the shortfall means a student outside London will need roughly £61,000 to meet this baseline standard, and around £77,000 if studying in London.

Those headline figures are grounded in the Minimum Income Standard for Students methodology, which uses focus groups of students in university cities to define a basket of goods and services deemed necessary for basic participation in university life. The approach — developed by the Centre for Research in Social Policy at Loughborough University and previously applied in a 2024 study — prices up essentials from food and utilities to clothing, travel and modest social participation, then adds a distinct “first‑year premium” for one‑off setting‑up costs (for example a laptop and bedding) and settling‑in expenses such as freshers’ activities. The research team stresses that these are minimum costs for full participation, not aspirational budgets.

Regional variation is material. Excluding rent, the study estimates first‑year students need about £260 a week; with rent included the average rises to the £418 figure. Annual living costs for first‑year students are estimated at about £21,126 in England generally, £20,208 in Wales, £19,836 in Scotland, £18,244 in Northern Ireland and £24,900 in London — where rent accounts for nearly half of total costs. The report highlights that students who rent privately after their first year face particularly high cumulative costs over a degree.

The mismatch between costs and maintenance support is uneven across the UK. For students domiciled and studying in England the maximum maintenance loan covers roughly half of first‑year costs; in Scotland and Wales the equivalent maximum support covers a somewhat larger share but still leaves substantial gaps. The analysis also flags a striking anomaly for students from Scotland who study in London: they receive no London weighting and therefore may see only around 46% of their costs covered, leaving an estimated annual shortfall of about £13,500.

When tuition is folded into the calculation the totals increase sharply. The research excludes tuition from its minimum living‑cost baskets but notes that the government raised the cap on standard undergraduate fees by 3.1% for 2025/26, bringing the maximum fee for a typical full‑time course to £9,535 where providers meet the relevant conditions. When fees are added, the report calculates the total cost of a standard three‑year degree in England can approach £90,000 — and exceed £100,000 for courses in London — although tuition fee loans are generally available to cover the fee element.

The study also considers the behavioural consequences of the shortfall. Even at maximum maintenance support, students in England would need to work more than 20 hours a week in term time and during vacations at National Minimum Wage rates to reach the minimum standard the report describes. The authors warn that such levels of paid employment risk undermining academic engagement and wellbeing, and that some students turn to high‑cost commercial borrowing to plug gaps.

The report’s authors and HEPI commentators draw a bleak conclusion about the wider implications. “These findings demonstrate three serious risks to UK higher education: access to higher education becomes more unequal, the quality of the student experience suffers and the sustainability of the sector is put at risk,” Josh Freeman writes in the concluding section of the report. Nick Hillman OBE, director of the Higher Education Policy Institute, said in the HEPI briefing that the numbers should prompt a “much‑needed conversation” about imputed parental contributions, the level of maintenance support and whether it is reasonable to expect most full‑time students to carry substantial paid work alongside their studies.

One of the private sector partners, TechnologyOne, framed the findings as a call for better institutional tools to support at‑risk students. Cheryl Watson, Education UK Vice‑President at TechnologyOne, said the research “reveals a widening gap between the expectations students bring to university and the reality they encounter” and argued that modern, connected technology could help universities intervene earlier. The company’s intervention should be treated as a sectoral perspective: TechnologyOne claims that better data and systems can improve engagement and wellbeing, but the report’s authors also emphasise that structural change to maintenance support — rather than technology alone — is required to close the affordability gap.

The research team recommends a redesign of student maintenance support built on five principles: simplicity, transparency, independence, sufficiency and fiscal neutrality. The authors urge policymakers to rethink how imputed parental contributions are calculated, to consider regional cost differences such as London weighting, and to design maintenance packages that do not force students into excessive work or high‑interest borrowing. The report frames these as practical steps to protect access, participation and student wellbeing.

HEPI, TechnologyOne and Loughborough’s Centre for Research in Social Policy will present the findings in a public webinar in September; the report’s proponents say their aim is to inform policymakers, university leaders and parents about the scale of the challenge and to stimulate evidence‑based reform. Whether political will materialises to translate the report’s recommendations into policy remains the central question for the sector.

Reference Map:

Reference Map:

Reference Map:

- Paragraph 1 – [1], [2], [4], [6]

- Paragraph 2 – [3], [7], [1]

- Paragraph 3 – [1], [2], [6]

- Paragraph 4 – [1], [2]

- Paragraph 5 – [1], [5], [4]

- Paragraph 6 – [1], [3], [6]

- Paragraph 7 – [1]

- Paragraph 8 – [1], [6]

- Paragraph 9 – [1], [3], [2]

- Paragraph 10 – [1], [2], [7]

Source: Noah Wire Services

- https://www.hepi.ac.uk/2025/08/12/maintenance-loan-in-england-now-covers-just-half-of-students-costs/ – Please view link – unable to able to access data

- https://www.hepi.ac.uk/2025/08/12/maintenance-loan-in-england-now-covers-just-half-of-students-costs/ – HEPI’s 12 August 2025 briefing presents findings from a new report (MISS25) showing that the maximum maintenance loan in England (£10,544) covers only around half of first-year students’ living costs. The piece summarises key statistics: weekly budgets of £260 excluding rent and £418 including rent for students in halls, annual living costs of £21,126 in England and £24,900 in London, and three‑year living totals of about £61,000 (England) and £77,000 (London), excluding tuition. It highlights a ‘first‑year premium’ for setup and settling‑in costs and notes recommended reforms to maintenance support to improve sufficiency and fairness and warns of rising student hardship.

- https://www.hepi.ac.uk/wp-content/uploads/2024/05/A-Minimum-Income-Standard-for-Students-1.pdf – The HEPI report ‘A Minimum Income Standard for Students’ (May 2024) by CRSP and HEPI sets out a student Minimum Income Standard using student focus groups and costings. It finds second/third‑year students need £18,632 outside London and £21,774 in London including rent, that maximum maintenance support falls short (covering roughly 55% in England outside London), and that students often must work excessive hours to meet costs. The study details methodology, budget items, parental contribution expectations, and policy recommendations including higher maintenance levels, clearer support, and further research to prevent financial barriers undermining access, participation and student wellbeing and reduce poverty.

- https://www.gov.uk/government/publications/student-finance-how-youre-assessed-and-paid/student-finance-how-youre-assessed-and-paid-2025-to-2026 – This GOV.UK guidance (Student finance: how you’re assessed and paid 2025 to 2026) explains maintenance loan and grant entitlements, household income assessment, and detailed maximum loan amounts. It shows the full‑rate maintenance loan figures for 2025/26 — for example £10,544 for students living away from home and studying outside London — and explains how grants interact with loans, household income thresholds, and entitlement tables for London and non‑London rates. The page clarifies assessment rules, payment arrangements, and special provisions, providing official government detail used to calculate the share of student costs covered by state support and processes.

- https://www.gov.uk/government/publications/tuition-fees-and-student-support-2025-to-2026-academic-year/changes-to-tuition-fees-2025-to-2026-academic-year – The GOV.UK publication ‘Changes to tuition fees: 2025 to 2026 academic year’ outlines the government’s decision to increase maximum undergraduate fee limits by 3.1% for 2025/26. It specifies the new caps — £9,535 for standard full‑time courses for approved providers with TEF and an access and participation plan — and lists adjusted amounts for accelerated and part‑time courses. The page explains the rationale, links to student loan availability to cover tuition, and provides context on the fee uplift’s application and implementation dates. It is the official source confirming the fee rise referenced in analysis of total degree costs and policy.

- https://www.technology1.co.uk/resources/reports/minimum-income-standard-for-students-2025 – TechnologyOne’s Minimum Income Standard for Students 2025 webpage summarises the MISS25 report co‑produced with HEPI and Loughborough’s CRSP, focusing on first‑year students in purpose‑built student accommodation. It highlights the ‘first‑year premium’ for setting up and settling in, notes students need higher budgets than later years, and states maximum maintenance support covers only around half of living costs in England. The page previews key findings such as working hours required to reach the minimum standard and recommends redesigning maintenance support. It offers access to the full report upon publication and positions the research as a practical tool for institutions and policymakers.

- https://www.lboro.ac.uk/research/crsp/our-research/minimum-income-standard-for-students/ – Loughborough University’s Centre for Research in Social Policy (CRSP) page describes the Minimum Income Standard (MIS) approach and its application to students. It explains the research process using focus groups across UK universities to define a basket of goods and services constituting a minimum socially acceptable student standard. The page summarises findings comparing budgets to government maintenance support, hours of paid work required, parental contributions, linking to HEPI publications. It emphasises methodological rigour, the role of student perspectives in defining needs, and the utility of MIS data for policy, institutional planning and debate about student living costs and support adequacy.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

10

Notes:

The narrative is recent, published on 12 August 2025, and presents new findings from a collaborative report by HEPI, TechnologyOne, and the Centre for Research in Social Policy at Loughborough University. No evidence suggests this content has been previously published or recycled. The report is based on recent research, ensuring high freshness.

Quotes check

Score:

10

Notes:

The direct quotes from Josh Freeman and Nick Hillman OBE are unique to this report, with no prior online matches found. This suggests the content is original or exclusive.

Source reliability

Score:

10

Notes:

The narrative originates from HEPI, a reputable UK-based think tank dedicated to higher education policy. The involvement of TechnologyOne and Loughborough University’s Centre for Research in Social Policy further enhances the credibility of the report.

Plausability check

Score:

10

Notes:

The claims regarding the shortfall between maintenance loans and living costs align with previous studies and reports, such as those by the Higher Education Policy Institute and the National Union of Students. The data presented is consistent with known trends in student living costs and financial support.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative is recent, original, and originates from a reputable source. The claims made are plausible and consistent with existing data on student living costs and maintenance support. No significant credibility risks were identified.