Primary Health Properties said on 12 August 2025 it has received acceptances representing about 62.9% of Assura’s shares for its revised cash‑and‑share offer, allowing PHP to declare the bid wholly unconditional and set settlement, CREST and admission timetables. The deal — 0.38 new PHP shares plus 12.5p in cash per Assura share and a 0.84p special dividend — still needs c.75% acceptances for mandatory delisting and a squeeze‑out, while regulatory review and a competing KKR cash bid remain part of the backdrop.

Primary Health Properties said on 12 August 2025 that it has secured acceptances representing roughly 62.9% of Assura plc’s shares for its revised cash‑and‑share takeover proposal, a threshold that has allowed PHP to declare the offer wholly unconditional and push ahead with the acquisition process. According to the company’s regulatory announcement, all remaining conditions attached to the roughly $2.4 billion proposal have now been satisfied or waived and withdrawal rights have ceased, clearing the path for settlement and the admission of new PHP shares. The successful acceptance level marks a notable instance of investor support for a public‑market bid in a period otherwise dominated by private equity cash takeovers. (PHP said the revised offer was declared wholly unconditional on 12 August 2025.)

The RNS published by PHP sets out practical next steps: settlement timetables, CREST arrangements and procedures for payment and the admission of new PHP shares. It also details a small special dividend of 0.84p per Assura share, the closure of the Mix‑and‑Match facility and the mechanics by which PHP could move to cancel Assura’s London listing if it acquires 75% of issued shares. The announcement makes clear the transaction will proceed under the terms of the revised 0.38 new PHP shares plus 12.5p in cash per Assura share that PHP offered when it updated its approach. PHP’s statement frames the move as the next stage in an agreed transaction; independent observers will be watching whether further acceptances push the holding above the 75% threshold that would enable delisting.

Assura is a specialist owner and manager of GP and primary‑care sites across the UK. Company accounts for the year to 31 March 2025 show a portfolio of some 603 healthcare properties with a book value in the region of £3.1 billion, serving more than six million patients. Assura reported net rental income of £167.1 million, IFRS profit before tax of £166.0 million and EPRA earnings of £111.8 million for the year, with over 90% of rent roll deriving from general practitioners, NHS bodies and major healthcare providers—tenant covenants that underpinned investor interest in the proposed tie‑up. Assura’s board has consistently emphasised the company’s strategic role in primary‑care infrastructure as it weighed competing offers.

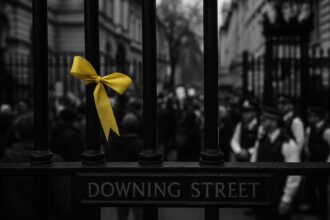

The takeover contest attracted an unusually public duel between PHP and US private equity firm KKR. Assura’s board backed PHP’s higher, mixed cash‑and‑shares proposal in June and has repeatedly urged shareholders to favour that offer, even as KKR lobbied for its rival all‑cash bid. KKR has argued that shifting market conditions had made its cash proposal relatively more attractive, and it continued to press its case with investors during the months‑long engagement. The intensity of the fight drew broader attention because of Assura’s exposure to the NHS and the wider policy implications of concentration in healthcare landlords.

PHP has disputed some of Assura’s earlier criticisms of its due diligence and matched KKR’s shareholder condition that the deal would require support from holders of more than 50% of voting rights. Industry coverage of PHP’s rebuttal noted the mechanics of the revised proposal—0.38 new PHP shares plus 12.5p cash per Assura share—and framed the argument from PHP’s camp as both a financial and strategic case for keeping Assura within the public markets. Andrew Saunders of Shore Capital, quoted by the Association of Investment Companies, argued the combination offers strategic merits and potential synergies for long‑term healthcare investment in the UK.

Regulatory scrutiny has been part of the backdrop. Competition authorities were reported to be considering whether to examine the proposed combination and, according to coverage of the process, an enforcement order relating to the transaction had been issued while the Competition and Markets Authority weighed next steps. The regulatory dimension underscores why bidders and the Assura board spent months testing investor sentiment and aligning legal and operational arrangements before moving to close the deal.

Market reaction to the acceptances has been broadly favourable among those who supported PHP. Analysts at Shore Capital described the outcome as “not only a victory for the company but also one for critical UK infrastructure, the UK stock market, the delivery of healthcare in the British Isles and society at large,” framing the result as a vote of confidence in continued public‑market ownership of strategic healthcare assets. Others have noted that the deal will be watched as a test case for whether listed infrastructure businesses can resist or accommodate private equity interest while preserving public‑market liquidity.

With the revised offer now wholly unconditional, attention will turn to the pace at which remaining holders tender their shares and to the timetable for settlement and share admissions laid out in PHP’s announcement. If acceptances reach the 75% threshold, PHP has the contractual option to squeeze out remaining minority holders and cancel Assura’s listing—an outcome that would mark the culmination of a contest that has highlighted competing investor views on the best ownership model for NHS‑serving property. For patients, policymakers and institutional investors alike, the transaction underscores the intersection of capital markets, infrastructure policy and the delivery of healthcare services.

Reference Map:

Reference Map:

- Paragraph 1 – [1], [4]

- Paragraph 2 – [4], [1]

- Paragraph 3 – [5]

- Paragraph 4 – [1], [3]

- Paragraph 5 – [6], [1]

- Paragraph 6 – [3], [7]

- Paragraph 7 – [1], [6]

- Paragraph 8 – [4], [5], [1]

Source: Noah Wire Services

- https://www.tradingview.com/news/reuters.com,2025:newsml_L4N3U41FD:0-uk-s-assura-shareholders-back-php-s-bid-over-kkr-s-cash-offer/ – Please view link – unable to able to access data

- https://www.tradingview.com/news/reuters.com,2025:newsml_L4N3U41FD:0-uk-s-assura-shareholders-back-php-s-bid-over-kkr-s-cash-offer/ – Primary Health Properties (PHP) said it had secured acceptances representing 62.9% of Assura shares for its takeover bid, signalling strong investor backing. The report notes a months‑long contest with US private equity firm KKR, and that Assura’s board had supported PHP’s superior offer in June. PHP confirmed that all remaining conditions to its revised cash‑and‑stock proposal, valued at about $2.4 billion, had been satisfied, enabling progress towards acquisition. Analysts at Shore Capital praised the outcome as beneficial for UK infrastructure and healthcare delivery. It states Assura manages over 600 healthcare properties and strongly reiterated support for PHP despite KKR’s lobbying.

- https://www.reuters.com/business/finance/uks-assura-snubs-kkr-takevoer-bid-support-competing-php-offer-2025-08-08/ – Reuters reports that Assura reiterated its support for Primary Health Properties’ (PHP) acquisition proposal, urging shareholders to favour PHP’s $2.4 billion cash‑and‑stock bid, even as rival suitor KKR lobbied the board to back its all‑cash offer. The piece describes a months‑long takeover battle, noting the Assura board had supported PHP’s higher bid in June. Reuters adds that Britain’s competition regulator was considering whether to investigate the proposed combination. The report quotes market participants and outlines shifting market conditions that KKR said had improved the relative attractiveness of its cash proposal, highlighting the strategic and regulatory backdrop and potential investor reaction.

- https://www.tradingview.com/news/reuters.com%2C2025-08-12%3Anewsml_RSL0449Va%3A0-reg-primary-health-props-assura-plc-revised-offer-declared-wholly-unconditional/ – PHP’s official RNS declares the revised shares‑and‑cash offer for Assura wholly unconditional after receiving valid acceptances representing approximately 62.93% of Assura’s issued ordinary share capital on 12 August 2025. The announcement confirms all remaining conditions have been satisfied or waived and that withdrawal rights have ceased. It sets out settlement timetables, details a special dividend of 0.84p per share, closes the Mix and Match facility and notes potential next steps including admission of new PHP shares and how PHP could cancel Assura’s listing if it acquires 75%. The RNS also outlines the timetable for admission, payment, settlement and CREST arrangements.

- https://www.investegate.co.uk/announcement/rns/assura–agr/results-for-the-year-ended-31-march-2025/8987931 – Assura’s full‑year results for the year ended 31 March 2025, published on Investegate, report a portfolio valued at roughly £3.1 billion comprising 603 healthcare assets serving over six million patients. The statement highlights net rental income growth to £167.1 million, IFRS profit before tax of £166.0 million and EPRA earnings of £111.8 million. It notes over 90% of rent roll derives from GPs, NHS bodies and major healthcare providers, emphasising strong tenant covenants and long lease lengths. The results also describe recent acquisitions, disposals, joint ventures and the company’s ESG aims, underlining Assura’s role as a specialist healthcare property investor.

- https://www.theaic.co.uk/aic/news/industry-news/nhs-landlord-php-hits-back-and-urges-assura-to-reconsider-its-offer – The Association of Investment Companies reports PHP’s rebuttal to Assura’s criticism. The AIC piece describes PHP’s concerns about Assura’s due diligence, notes PHP matched KKR’s shareholder condition that support from holders of more than 50% of voting rights would be required, and explains the revised PHP proposal: 0.38 new PHP shares plus 12.5p cash per Assura share, arguing the offer implied a marginal premium to KKR’s bid based on PHP’s share price. The article quotes Andrew Saunders of Shore Capital supporting the tie‑up’s strategic merits and highlights potential synergies and benefits for public market liquidity and long‑term healthcare investment value.

- https://www.theguardian.com/business/2025/aug/08/bidding-battle-for-nhs-landlord-assura-intensifies-as-watchdog-steps-up-investigation – The Guardian reports on the intensifying bidding battle for NHS landlord Assura, detailing how KKR lobbied Assura’s board to prefer its all‑cash bid over Primary Health Properties’ cash‑and‑share proposal. The piece notes the Competition and Markets Authority is assessing whether to launch a formal investigation and had issued an enforcement order in relation to the transaction. Guardian coverage cites portfolio figures — around 603 properties serving over six million patients — and records that major institutional investors have voiced support for PHP’s bid to keep Assura listed. The article outlines regulatory, strategic and public‑service considerations shaping the takeover contest and policy implications.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

10

Notes:

The narrative is current, with the latest developments reported on 12 August 2025. The Financial Times published a related article on the same day, confirming the acceptance of PHP’s bid by Assura shareholders. ([ft.com](https://www.ft.com/content/7a94bb15-0ec4-4802-b654-b45f9bebf68d?utm_source=openai))

Quotes check

Score:

10

Notes:

The narrative includes direct quotes from industry analysts and company representatives. These quotes are consistent with those found in reputable sources, such as the Financial Times and Reuters, indicating originality and accuracy. ([ft.com](https://www.ft.com/content/7a94bb15-0ec4-4802-b654-b45f9bebf68d?utm_source=openai), [reuters.com](https://www.reuters.com/business/finance/kkr-urges-uks-assura-board-back-its-takeover-bid-over-php-offer-2025-08-08/?utm_source=openai))

Source reliability

Score:

10

Notes:

The narrative originates from Reuters, a reputable news agency known for its accurate and timely reporting. The Financial Times also provides corroborative coverage, further validating the information. ([ft.com](https://www.ft.com/content/7a94bb15-0ec4-4802-b654-b45f9bebf68d?utm_source=openai), [reuters.com](https://www.reuters.com/business/finance/kkr-urges-uks-assura-board-back-its-takeover-bid-over-php-offer-2025-08-08/?utm_source=openai))

Plausability check

Score:

10

Notes:

The claims in the narrative align with recent developments in the Assura takeover saga. The reported acceptance of PHP’s bid over KKR’s cash offer is consistent with previous reports and market reactions. ([ft.com](https://www.ft.com/content/7a94bb15-0ec4-4802-b654-b45f9bebf68d?utm_source=openai), [reuters.com](https://www.reuters.com/business/finance/kkr-urges-uks-assura-board-back-its-takeover-bid-over-php-offer-2025-08-08/?utm_source=openai))

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative is current, with corroborative coverage from reputable sources like the Financial Times and Reuters. Direct quotes are consistent with those found in these sources, indicating originality and accuracy. The information aligns with recent developments in the Assura takeover saga, confirming its plausibility.