Hays PLC reported an 11% fall in net fees and a 90% plunge in pre-tax profits as permanent placements weakened and Germany’s autos-exposed market hit revenues, prompting an aggressive cost-cutting plan targeting c.£80m of annual savings and about 1,000 job cuts.

Hays PLC, the global recruitment group, delivered a sobering update on its full-year results, painting a picture of a hiring market still mired in uncertainty across its biggest geographies. In the year to 30 June, the company reported net fees of £972.4 million, down 11% on a like-for-like basis, with permanent recruitment the weakest link as volumes contracted sharply across major markets. The firm said the difficult market translated into a dramatic drop in profitability, with pre-tax profits tumbling by 90% year on year to just £1.5 million and profit before exceptional items down by around two-thirds to £32.2 million. The numbers underline a stark reality for Hays as it grapples with a combination of macroeconomic headwinds and sector-specific softness, particularly in Germany, which the group has long viewed as a key driver of profits.

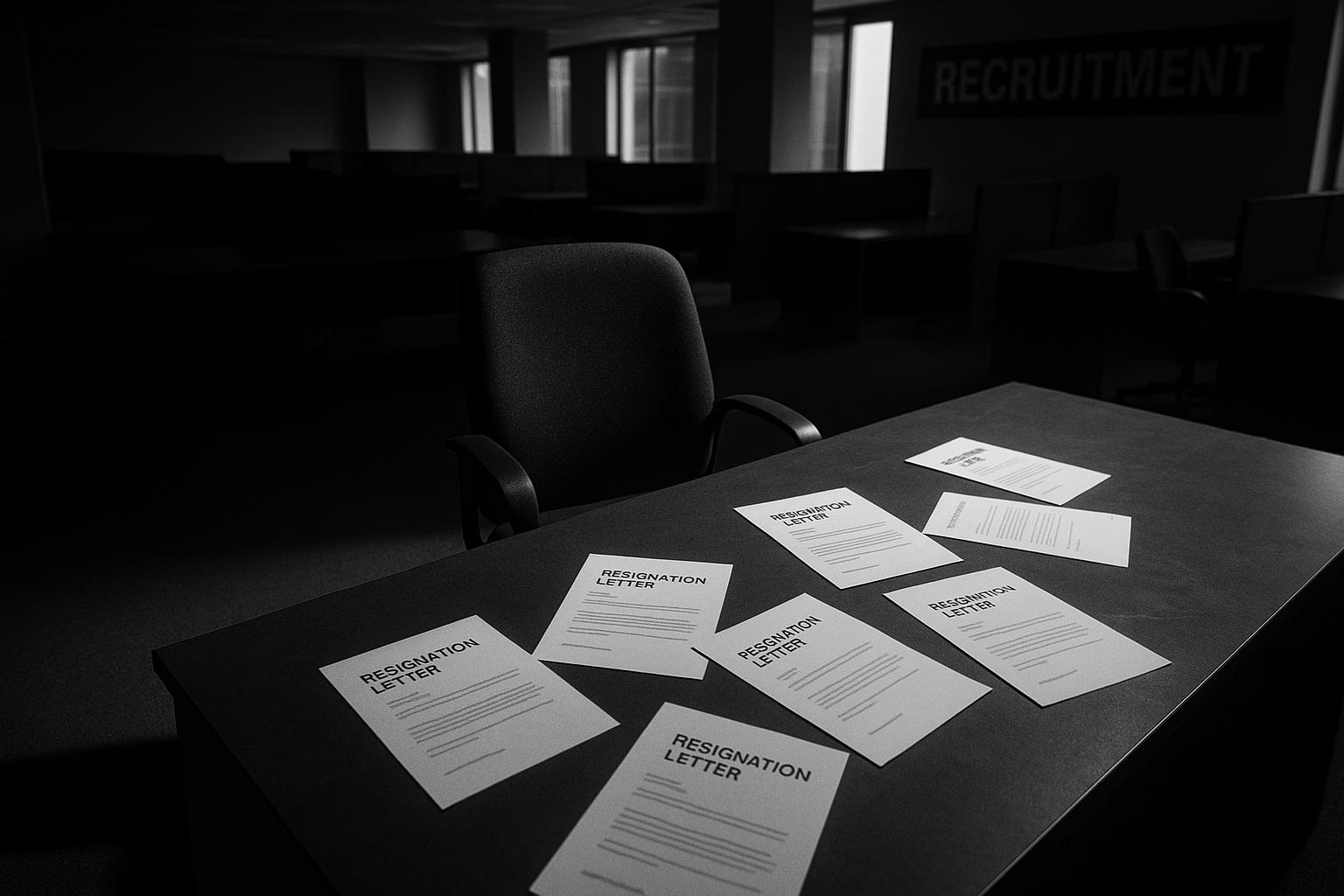

The company has responded with an aggressive cost-control programme designed to reshape its cost base in a slower-for-longer environment. Hays disclosed around £35 million of annual structural savings and laid out a target to achieve a further £45 million of annual savings by FY29, lifting the cumulative programme to about £80 million. As part of that effort, the group has closed or merged 29 offices over the past year and reduced its recruitment consultant headcount by roughly 14%, a global move that coincided with the elimination of nearly 1,000 roles worldwide, including about 350 in the UK and Ireland. Despite these measures, management warned that activity in July and August had not meaningfully improved and it was too early to judge September, a traditionally important trading month for the sector. The company attributed its stubbornly weak results to a persistent slow jobs market and the particular weakness of Germany, while emphasising that its strategy remains focused on prioritising in-demand sectors, roles and geographies and expanding exposure to temporary and contracting recruitment. The market has reacted with caution; current trading in the near term was described as broadly in line with expectations, according to the group’s update in mid-July. According to the company’s statements reported by market observers, the outlook hinges on a broader recovery in hiring activity and the timing of market stabilisation, especially in Europe’s autos-intensive economy.

Beyond Germany, analysts noted that the broader macro environment continues to weigh on the group’s earnings trajectory. Reuters highlighted that the full-year pre-exceptional operating profit was guided towards around £45 million, a fall of more than 57% versus consensus expectations, with the firm pointing to a broad slowdown in permanent hiring and longer decision times across regions. Germany’s exposure to the automotive sector and tariff concerns contributed to the weakness, underscoring the challenge of translating cost discipline into sustained profitability. The Guardian likewise reported that profits are expected to be halved in the face of global hiring slowdowns, with autos demand and tariff chatter amplifying weakness in the European market. Meanwhile, City A.M. noted that management continues to press ahead with its efficiency drive while maintaining a focus on productivity improvements, even as current trading remains subdued.

Taken together, the updates reflect a company that has acted decisively to shore up margins in a difficult environment, while remaining unperturbed about the longer-term opportunity set in its core markets. The scale of cost savings and office consolidation points to a company intent on preserving cash flow and competitive position during a period of structural nerves in the labour market. However, with Germany continuing to weigh on the group’s profitability and with the broader hiring cycle still uncertain, investors and clients alike will be watching closely for signs of a meaningful upturn in client confidence and candidate activity. Industry observers emphasise that the next several quarters will be critical in determining whether Hays can translate its cost-base reductions into a sustainable improvement in profits as market conditions gradually improve.

Reference Map:

Source: Noah Wire Services

- https://www.independent.co.uk/news/business/europe-hays-germany-b2811509.html – Please view link – unable to able to access data

- https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698 – Investegate reports Hays plc’s preliminary results for the year ended 30 June 2025. Net fees declined 11% year-on-year to £972.4 million, with like-for-like comparisons highlighting weaker permanent recruitment. Operating profit before exceptional items fell 56% to £45.6 million as the group continued to implement its efficiency programme. Cash generation remained robust, with £128.3 million from operations and a cash conversion of 281%. The company disclosed an annual cost-saving drive of around £35 million, with a plan to achieve a further £45 million per annum by FY29. Current trading in July and August was in line with expectations, suggesting stabilisation ahead.

- https://www.marketscreener.com/news/hays-preliminary-results-for-the-year-ended-30-june-2025-press-release-ce7c51d3d881f621 – Hays plc released Preliminary Results for the year ended 30 June 2025. Net fees were £972.4 million, down 11% from the prior year, with permanent recruitment driving most of the decline (net fees down 17% in Perm, while Temp & Contracting fell 7%). Group turnover totalled £6.607 billion. Pre-exceptional operating profit came in at £45.6 million, with £30.7 million of exceptional items; cash generation was robust. The company reported £35 million in structural cost savings and targeted around £45 million more by FY29. The office network reduced to 207 locations, as 29 offices were closed or consolidated in FY25 globally.

- https://www.standard.co.uk/business/business-news/europe-germany-german-b1243866.html – Global recruitment chain Hays reported plunging profits as it faced a weak hiring environment. Net fees were £972.4m, 11% below the previous year; permanent hiring volumes fell about 17%, with temp/contracting down less. Pre-tax profits dropped 91% to around £1.5m; pre-exceptional operating profit declined to £32.2m, with total cost savings of £35m per year and a plan to reach £80m by 2029 after additional £45m per annum. The company highlighted that in the past year it closed or merged 29 global offices, reducing the consultant headcount by about 14% and cutting around 1,000 roles worldwide, including £350 in UK&I alone.

- https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/ – Hays warned that full-year pre-exceptional operating profit would fall to around £45 million, down more than 57% on market expectations. CEO Dirk Hahn cited a broad slowdown in permanent hiring and longer decision times, with Germany’s automotive exposure weighing on volumes. The update underscored persistent macroeconomic uncertainty and reduced hiring activity across regions, with like-for-like net fees pressured across the group. Shares fell sharply as investors digested the guidance. The Reuters piece connects the German weakness and tariff backdrop to the revenue decline and profit outlook, while acknowledging temp/contracting performance remained comparatively steadier. Overall, market environment remains unpredictable for FY25.

- https://www.theguardian.com/business/2025/jun/19/recruiter-hays-warns-global-slump-in-hirings-halve-its-profits – Hays has warned that profits will be halved as hiring across the globe slows, sending shares lower. The unscheduled update forecasts pre-exceptional operating profit around £45m for the year, well below city forecasts, with permanent hiring seeing a steep drop while temporary/contracting proves more resilient. The German market remains pivotal to group profitability, with autos exposure amplifying weakness amid tariff chatter and weaker demand across Europe. The Guardian notes the warning comes amid macroeconomic uncertainty and a pull-back in client and candidate confidence. The story highlights the scale of the challenge facing Hays as it pursues a multi-year cost-saving programme.

- https://www.cityam.com/hays-recuiter-issues-profit-warning-amid-job-market-woes/ – Hays issued a profit warning citing continuing market weakness and the likelihood of year-end results missing consensus expectations. The firm now expects pre-exceptional operating profits around £45 million for FY25, well below forecasts. Permanent hiring remains the weakest area, with overall like-for-like net fees anticipated to fall around 9%. The company notes Germany remains the biggest contributor to profits but faces pressure from autos and tariff concerns. Management also emphasised ongoing cost-cutting and efficiency programmes to lower the cost base, while maintaining focus on productivity improvements. July–August trading had been broadly in line with expectations for current and future years.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

7

Notes:

The narrative relies on Hays PLC’s company preliminary report published 21 August 2025 (full-year numbers and measures) — this is the primary, authoritative disclosure and justifies a high freshness rating for the finalised figures. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

The narrative relies on Hays PLC’s company preliminary report published 21 August 2025 (full-year numbers and measures) — this is the primary, authoritative disclosure and justifies a high freshness rating for the finalised figures. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))  However, a substantially similar story (a profit warning / downgrade) first appeared on 19 June 2025 (company trading update / profit warning) and was widely covered — that earlier narrative pre-dates these final numbers by >7 days and is material to context. ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com), [proactiveinvestors.co.uk](https://www.proactiveinvestors.co.uk/companies/news/1073255/hays-shares-drop-14-as-profit-warning-highlights-slump-in-hiring-1073255.html?utm_source=chatgpt.com))

However, a substantially similar story (a profit warning / downgrade) first appeared on 19 June 2025 (company trading update / profit warning) and was widely covered — that earlier narrative pre-dates these final numbers by >7 days and is material to context. ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com), [proactiveinvestors.co.uk](https://www.proactiveinvestors.co.uk/companies/news/1073255/hays-shares-drop-14-as-profit-warning-highlights-slump-in-hiring-1073255.html?utm_source=chatgpt.com))  Editors should note: June 19 covered the profit downgrade; the 21 Aug RNS supplies the confirmed FY25 totals (net fees £972.4m, profit before tax £1.5m, pre-exceptional PBT £32.2m) and the cost‑savings/office/headcount detail. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

Editors should note: June 19 covered the profit downgrade; the 21 Aug RNS supplies the confirmed FY25 totals (net fees £972.4m, profit before tax £1.5m, pre-exceptional PBT £32.2m) and the cost‑savings/office/headcount detail. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

Quotes check

Score:

3

Notes:

The direct quotes attributed to Dirk Hahn appear verbatim in the company’s RNS / preliminary report (21 Aug 2025) and have been reproduced by multiple outlets — i.e. the wording is not exclusive to the Independent and is reused corporate text. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698), [independent.co.uk](https://www.independent.co.uk/news/business/europe-hays-germany-b2811509.html)) 🛈 A similar theme and related phrasing have appeared in Hays’ earlier prepared remarks and interim statements (so some language is recurring), but the exact quote block used in the piece matches the 21 Aug RNS. ([marketscreener.com](https://www.marketscreener.com/quote/stock/HAYS-PLC-4000880/news/Hays-Financial-document-Copy-of-Prepared-Remarks-FINAL-49112785/?utm_source=chatgpt.com), [investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698))

The direct quotes attributed to Dirk Hahn appear verbatim in the company’s RNS / preliminary report (21 Aug 2025) and have been reproduced by multiple outlets — i.e. the wording is not exclusive to the Independent and is reused corporate text. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698), [independent.co.uk](https://www.independent.co.uk/news/business/europe-hays-germany-b2811509.html)) 🛈 A similar theme and related phrasing have appeared in Hays’ earlier prepared remarks and interim statements (so some language is recurring), but the exact quote block used in the piece matches the 21 Aug RNS. ([marketscreener.com](https://www.marketscreener.com/quote/stock/HAYS-PLC-4000880/news/Hays-Financial-document-Copy-of-Prepared-Remarks-FINAL-49112785/?utm_source=chatgpt.com), [investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698))  If the article claims the quote is an exclusive interview, that would be inaccurate; it is a company comment published in the RNS.

If the article claims the quote is an exclusive interview, that would be inaccurate; it is a company comment published in the RNS.

Source reliability

Score:

9

Notes:

Core factual claims (financials, headcount, cost-savings) are traceable to the firm’s regulatory filing (RNS / preliminary report) — a primary and authoritative source for company financial disclosure. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

Core factual claims (financials, headcount, cost-savings) are traceable to the firm’s regulatory filing (RNS / preliminary report) — a primary and authoritative source for company financial disclosure. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))  The narrative is corroborated by major reputable outlets (Reuters, The Guardian, Reuters’ June trading-update coverage) which increases confidence. ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com), [theguardian.com](https://www.theguardian.com/business/2025/jun/19/recruiter-hays-warns-global-slump-in-hirings-halve-its-profits?utm_source=chatgpt.com))

The narrative is corroborated by major reputable outlets (Reuters, The Guardian, Reuters’ June trading-update coverage) which increases confidence. ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com), [theguardian.com](https://www.theguardian.com/business/2025/jun/19/recruiter-hays-warns-global-slump-in-hirings-halve-its-profits?utm_source=chatgpt.com))  A number of wire/aggregator pages republished the RNS verbatim (MarketScreener / Investegate) — this is normal for corporate news but means the story is largely the company’s messaging rather than independent investigative reporting. ([marketscreener.com](https://www.marketscreener.com/news/hays-preliminary-results-for-the-year-ended-30-june-2025-press-release-ce7c51d3d881f621?utm_source=chatgpt.com), [investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

A number of wire/aggregator pages republished the RNS verbatim (MarketScreener / Investegate) — this is normal for corporate news but means the story is largely the company’s messaging rather than independent investigative reporting. ([marketscreener.com](https://www.marketscreener.com/news/hays-preliminary-results-for-the-year-ended-30-june-2025-press-release-ce7c51d3d881f621?utm_source=chatgpt.com), [investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

Plausability check

Score:

8

Notes:

The headline claims and numeric details (net fees £972.4m, pre-exceptional operating profit ~£45.6m, profit before tax £1.5m, ~£35m realised savings and target for further £45m to FY29, 29 offices closed, ~14% consultant reduction) match the company’s RNS and are therefore plausible. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

The headline claims and numeric details (net fees £972.4m, pre-exceptional operating profit ~£45.6m, profit before tax £1.5m, ~£35m realised savings and target for further £45m to FY29, 29 offices closed, ~14% consultant reduction) match the company’s RNS and are therefore plausible. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))  Minor phrasing differences: the article’s phrase “elimination of nearly 1,000 roles worldwide” aligns with the RNS consultant headcount fall (7,045 → 6,070 ≈ 975 consultants) but the RNS also shows non-consultant reductions — total role change depends on which categories are counted; the exact “about 350 in the UK and Ireland” figure is reported by media summaries but is not given as a single-line figure in the RNS and should be verified if precision is required. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698), [standard.co.uk](https://www.standard.co.uk/business/business-news/europe-germany-german-b1243866.html?utm_source=chatgpt.com))

Minor phrasing differences: the article’s phrase “elimination of nearly 1,000 roles worldwide” aligns with the RNS consultant headcount fall (7,045 → 6,070 ≈ 975 consultants) but the RNS also shows non-consultant reductions — total role change depends on which categories are counted; the exact “about 350 in the UK and Ireland” figure is reported by media summaries but is not given as a single-line figure in the RNS and should be verified if precision is required. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698), [standard.co.uk](https://www.standard.co.uk/business/business-news/europe-germany-german-b1243866.html?utm_source=chatgpt.com))  The June 19 profit‑warning narrative differs in emphasis (an earlier downgrade / guidance change) and pre-dates the RNS release — treat June coverage as a separate (earlier) event that the 21 Aug RNS confirms/updates. ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com))

The June 19 profit‑warning narrative differs in emphasis (an earlier downgrade / guidance change) and pre-dates the RNS release — treat June coverage as a separate (earlier) event that the 21 Aug RNS confirms/updates. ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com))

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The report’s central factual claims are supported by Hays PLC’s official RNS / preliminary report published 21 August 2025 and by coverage in major outlets; the numbers, cost‑saving targets and broad headcount/office actions are traceable to the company filing, so the piece passes basic factual verification. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))

The report’s central factual claims are supported by Hays PLC’s official RNS / preliminary report published 21 August 2025 and by coverage in major outlets; the numbers, cost‑saving targets and broad headcount/office actions are traceable to the company filing, so the piece passes basic factual verification. ([investegate.co.uk](https://www.investegate.co.uk/announcement/rns/hays–has/preliminary-report-2025/9066698?utm_source=chatgpt.com))  Major risks to note: (1) this is largely company-sourced content / press release text (quotes and figures are drawn from the RNS and have been widely republished) so originality is low — readers should be clear they are reading a company update rather than independent investigative reporting; ([marketscreener.com](https://www.marketscreener.com/news/hays-preliminary-results-for-the-year-ended-30-june-2025-press-release-ce7c51d3d881f621?utm_source=chatgpt.com)) (2) a related profit‑warning narrative was published on 19 June 2025 and some outlets reported earlier guidance differences — that prior coverage should be referenced for full context because it pre-dates this RNS by >7 days; ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com)) (3) small discrepancies in how reductions are described (e.g. “nearly 1,000 roles” vs total headcount figures across consultant/non-consultant categories, and the ‘about 350 in the UK & Ireland’ line) should be clarified against the RNS if exact counts are important — otherwise the piece is materially accurate.

Major risks to note: (1) this is largely company-sourced content / press release text (quotes and figures are drawn from the RNS and have been widely republished) so originality is low — readers should be clear they are reading a company update rather than independent investigative reporting; ([marketscreener.com](https://www.marketscreener.com/news/hays-preliminary-results-for-the-year-ended-30-june-2025-press-release-ce7c51d3d881f621?utm_source=chatgpt.com)) (2) a related profit‑warning narrative was published on 19 June 2025 and some outlets reported earlier guidance differences — that prior coverage should be referenced for full context because it pre-dates this RNS by >7 days; ([reuters.com](https://www.reuters.com/world/uk/british-recruiter-hays-forecasts-57-annual-profit-slump-hiring-slowdown-2025-06-19/?utm_source=chatgpt.com)) (3) small discrepancies in how reductions are described (e.g. “nearly 1,000 roles” vs total headcount figures across consultant/non-consultant categories, and the ‘about 350 in the UK & Ireland’ line) should be clarified against the RNS if exact counts are important — otherwise the piece is materially accurate.  Overall: PASS (HIGH confidence) — accurate reporting of a company disclosure, but flagged for being primarily republished corporate messaging and for the presence of an earlier, related June profit-warning story.

Overall: PASS (HIGH confidence) — accurate reporting of a company disclosure, but flagged for being primarily republished corporate messaging and for the presence of an earlier, related June profit-warning story.