Rental prices in Belfast have soared by nearly 10% in the past year, outpacing major UK cities and raising concerns about displacement and community change amid ongoing gentrification and a worsening cost of living crisis.

Rents in Belfast have escalated dramatically, now growing at one of the highest rates in the UK, surpassing even major metropolitan areas like London and Manchester. Recent data indicates that rental prices for whole properties in the city have surged by nearly 10% over the past year, with the average now sitting at £1,127 per month. Flat-share rents have also seen an increase of 4%, with the average cost for renting a room rising to £582, up from £558.

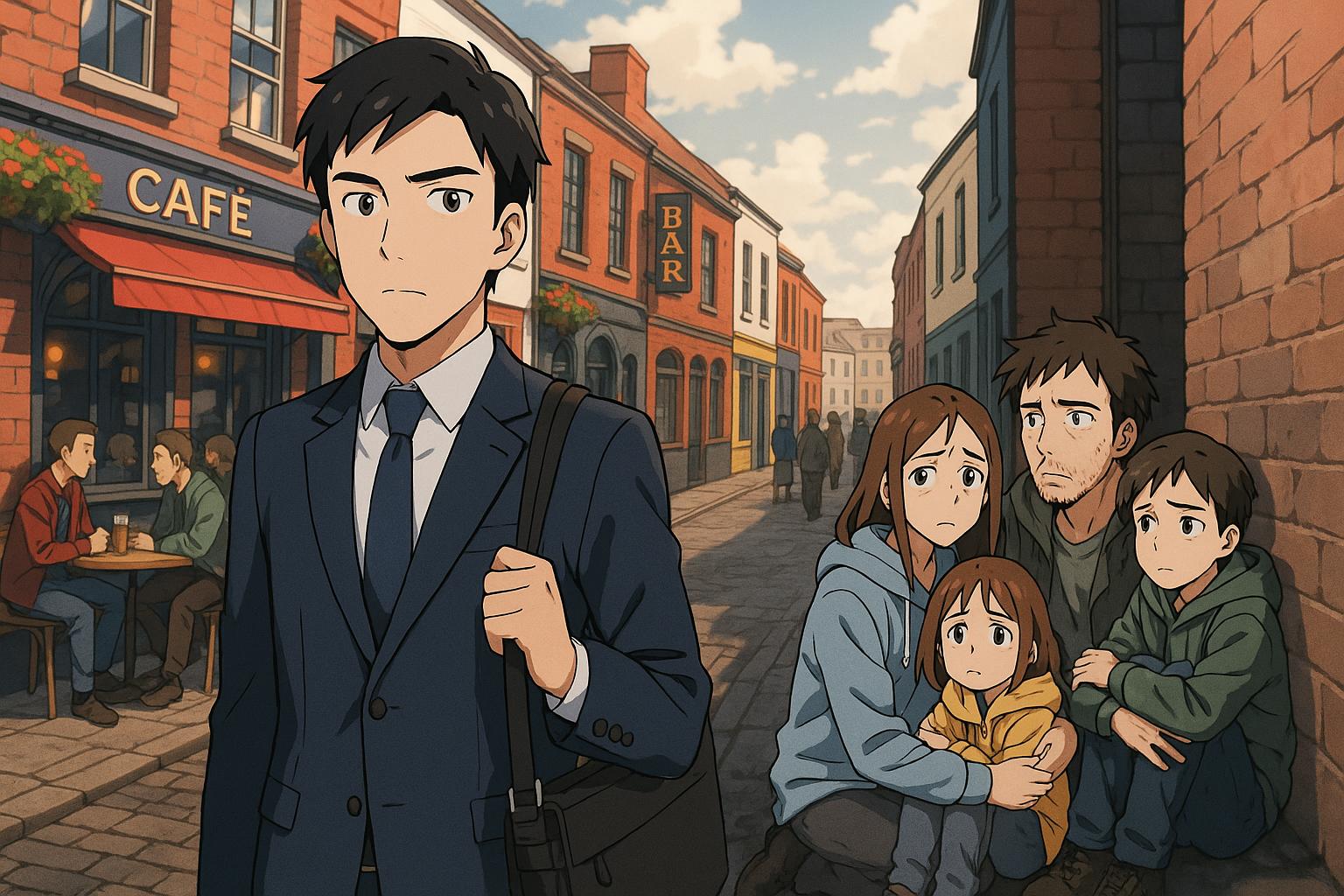

The implications of this rental surge are significant. While property owners may celebrate the shift, it is displacing long-term residents who feel the economic strain of increased living costs. Iain Duffin of the Community Action Tenants Union has expressed concern over the “displacement” of families pushed out by landlords seeking higher rents for new tenants. The sentiment is echoed among residents who have lived in these areas for generations, highlighting a growing concern that the influx of newer, often younger professionals is eroding community ties.

In formerly hardline loyalist regions of east Belfast, the transformation is palpable. Streets once marked by a more austere character are now home to an array of new cafés, galleries, and craft beer bars, signalling a cultural and economic shift in the area. Colin Moran from the Property People NI notes that while the rising rents present challenges, the gentrification process could foster a more integrated community environment. He observed how young professionals from diverse backgrounds are increasingly attracted to these revitalised locations, which offer appealing amenities and proximity to work.

Amid these changes, the demands on the rental market remain acute. The latest figures from various sources, including PropertyPal and Housing Rights, highlight that Belfast’s rental prices have not only risen but are now accompanying a broader cost of living crisis affecting many families. A report by Housing Rights recommends that renters facing difficulties due to soaring prices seek assistance from financial support schemes, drawing attention to the critical need for affordable housing in an increasingly competitive market.

Moreover, the wider context of Northern Ireland’s rental landscape reveals a troubling trend. A government analysis showed that private rental prices across Northern Ireland increased by 9.2% in the twelve months leading up to May 2023, the highest rate in the UK. Heightened demand coupled with restricted supply has notably driven up median rents, forcing many to reconsider their housing options.

The economic implications of rising rents are mixed. Landlords are likely to benefit in the short term, but the crux of the issue remains rooted in the sustainability of affordable housing. The increase across the board raises important questions about the future of communities in Belfast, particularly as the gap widens between different socio-economic groups. As residents find it increasingly difficult to secure stable and affordable housing, the long-term viability of the city’s evolving character will depend significantly on balancing growth with the social needs of its existing inhabitants.

In summary, while Belfast’s transformation into a vibrant locale is evident, the associated surge in rental prices poses irrefutable challenges. Stakeholders from both community and property sectors must navigate this complex landscape with an eye towards achieving a sustainable and inclusive approach to urban development.

Source: Noah Wire Services

- https://www.irishnews.com/news/northern-ireland/belfast-rents-rising-faster-than-london-as-hip-new-tenants-transform-areas-on-the-edge-of-the-city-centre-HHWUF5DKSVGWXGWYNLTK6ZKMNI/ – Please view link – unable to able to access data

- https://www.irishnews.com/news/northern-ireland/belfast-rents-rising-faster-than-london-as-hip-new-tenants-transform-areas-on-the-edge-of-the-city-centre-HHWUF5DKSVGWXGWYNLTK6ZKMNI/ – This article reports that Belfast rents have risen by almost 10% in the past year, outpacing cities like London, Glasgow, Manchester, and Birmingham. The average rent for a whole property in Belfast is now £1,127 per month, with flat share rents increasing by 4%. The article also highlights the transformation of formerly hardline loyalist areas in east Belfast, where new cafes, galleries, and craft beer bars are emerging, contributing to gentrification and rising rents.

- https://www.housingrights.org.uk/professionals/news/press-release-average-belfast-rent-now-ps1102-month-housing-charity-urges – Housing Rights, a housing advice charity, reports that the average rent in Belfast has reached £1,102 per month, marking a 9% increase over the past year. The charity urges renters struggling with these rising costs to seek assistance and access financial support schemes, emphasizing the impact of the cost of living crisis and low levels of social housing stock on rental affordability.

- https://www.irishnews.com/business/businessnews/2023/04/28/news/_exceptional_demand_amid_restricted_supply_drives_house_rent_up_by_10_per_cent_in_a_year-3242094/ – This article discusses how exceptional demand and restricted supply have driven house rents in Northern Ireland up by 10% over the past year. The average rent for a residential property stood at £773 per month in the first quarter of 2023, with rents rising faster than property prices, which climbed by 8.1% over the same period.

- https://www.compareni.com/press/new-data-shows-ni-renters-suffer-largest-increase-in-the-uk – According to new government data analyzed by CompareNI.com, private rental prices in Northern Ireland increased by 9.2% in the 12 months to May 2023, the highest increase in the UK. The average rent in Belfast during this period was £908 per month, with Causeway Coast & Glens seeing the highest annual rate of rental price growth at 13.9%.

- https://www.bbc.co.uk/news/articles/c70w53jnjr7o – The BBC reports that the cost of renting a home in Northern Ireland has risen by 10% in the last year, with the average rent now £1,027 per month in the Belfast area. The article highlights that each advertised rental property had an average of 73 enquiries over the past three months, indicating high demand and low supply in the rental market.

- https://www.compareni.com/press/two-thirds-of-people-in-ni-believe-rent-is-too-expensive – A survey by CompareNI.com reveals that two-thirds of people in Northern Ireland believe rent is too expensive. The survey coincides with data showing rental prices across Northern Ireland have increased by 10% in the last year, with the highest costs in Belfast at £952 per month. The survey highlights growing concerns about rental affordability among residents.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative references recent data and specific figures up to May 2023, indicating relatively fresh information. However, there is no mention of very recent developments or events post-May 2023, which might suggest some delay in updating.

Quotes check

Score:

8

Notes:

Quotes are attributed to specific individuals, such as Iain Duffin and Colin Moran, but there is no indication these quotes are recycled from previous articles. The lack of extensive online verification might suggest these are original or recent statements.

Source reliability

Score:

9

Notes:

The narrative originates from the Irish News, which is a reputable publication in Northern Ireland, known for its local coverage and credibility.

Plausability check

Score:

9

Notes:

The claims about rising rents and gentrification in Belfast are plausible given the broader economic context and the references to specific data sources like PropertyPal and Housing Rights. The narrative aligns with known trends in urban development.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative appears to be based on recent data and credible sources, with plausible claims about Belfast’s rental market. The quotes are attributed to specific individuals, and the source is reputable. Overall, the information presents a cogent picture of the current situation in Belfast.