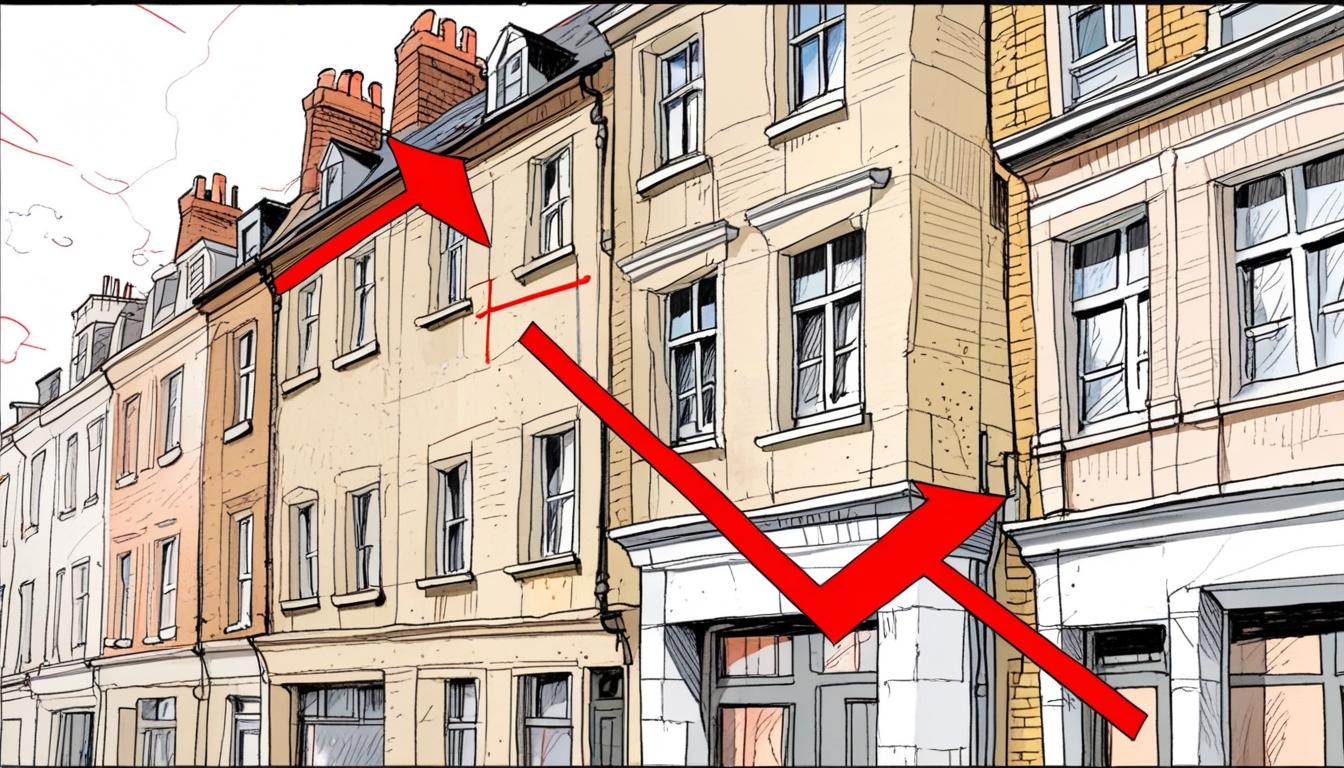

Central London is facing a sharp decline in property values, with some boroughs experiencing falls of over 25%. High-end areas like Belgravia and Kensington see prolonged selling times and significant price reductions amid buyer caution and economic uncertainties.

Home sellers in central London are grappling with a stark reality: properties may not be worth what they once were, undermining long-held assumptions about the capital’s robust real estate market. Recent data reveals that various boroughs in central London are experiencing significant declines in property values, with some areas seeing prices fall by over 20% in just four years. Alarmingly, one borough has reported a staggering 25% drop in its house prices over the last two years.

Amidst a backdrop of continued optimism from some estate agents, data from TwentyCi highlights that eight of the ten most difficult postcodes to sell homes in England are located within London. The findings are drawn from comprehensive metrics, including sold prices versus original asking prices, the quickness of sales, the likelihood of transactions falling through, and the frequency of price reductions. Currently, homes in central London are achieving an average of 96.1% of their original asking prices, lower than the national average of 97%. For a property initially listed at £1 million, this implies a sale price closer to £961,000—a troubling statistic for sellers.

Adding to the woes, the sale completion rate for homes in inner London stands at only 37%, significantly lower than the UK’s overall completion rate of 55%. The landscape is further marred by a high 39% of listings facing at least one price reduction, with a fall-through rate of 25.5%, marginally above the national average. The time taken to sell in London now averages 89 days, compared to 84 days across the country.

Particularly grim statistics emerge from hot spots like Marylebone, where properties are sealing deals at an average of just 88.1% of their original asking price. A house listed for £1 million would typically fetch £881,000, and nearly 35.5% of homes under offer in this area fail to complete, contributing to an increasingly problematic market. In the high-end areas of Belgravia, Knightsbridge, and Chelsea, selling a home can take an average of 201 days—almost two and a half times longer than the national average. Meanwhile, close to half of the homes listed in Pimlico undergo at least one price reduction.

The City of Westminster, once a bastion of luxury living, has witnessed average house prices fall by a dramatic 25% since their peak in January 2023, with average values now hovering around £920,000, a stark drop from highs of £1,225,000. Similarly, Kensington and Chelsea have seen an average price decrease of 28.5% since October 2021, with prices now at £1,183,000, down from £1,653,000.

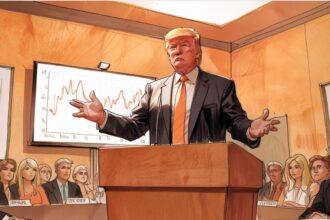

Market analysts cite a range of contributing factors influencing these declines, including rising interest rates, the ramifications of Brexit, and shifts in taxation laws, which are prompting some of the capital’s wealthiest residents to reconsider their investments in London property. According to Jonathan Hopper, CEO of Garrington Property Finders, the exodus of affluent buyers is partly driven by political instability and a recalibration of London’s prime property market. He indicated that a significant number are choosing to sell up, while others pivot towards the more attractive lettings market instead.

In an environment where costly stamp duty has become a deterrent, a buyer purchasing a £1 million property now faces stamp duty costs of £43,750, escalating to £93,750 for second properties and reaching £113,750 for overseas buyers. David Johnson, managing director of property consultancy INHOUS, posits that unrealistic pricing expectations are exacerbating the situation, as many agents inflate property values to attract sellers. He notes an uptick in the number of high-value properties being listed, as affluent investors reassess their commitments amid evolving economic landscapes.

The stakes are high for prospective buyers. Henry Pryor, a professional buying agent, suggests that the market dynamics have shifted dramatically. He notes an increase in high-value homes entering the market, signalling a landscape where buyers are less eager to act impulsively. Reports indicate that significant numbers of homes worth over £5 million have surged by 30% from early last year, but buyer hesitancy remains dominant as many choose to wait for more favourable conditions.

Despite the prevailing slowdown, some analysts see potential opportunities for those ready to navigate this uncertain terrain. Pryor contends that while the current climate may appear bleak, savvy buyers might find an advantageous position amid decreasing competition, as fewer buyers are willing to engage in bidding wars. He cautions, however, that the upcoming months will likely see continued volatility in the market, reflecting broader economic uncertainties.

As central London grapples with these challenging conditions, the landscape of property investment may shift fundamentally; what was once viewed as prime real estate is now subject to the same market pressures as the rest of the country, demanding a recalibration of expectations from both buyers and sellers alike.

Reference Map

- Paragraph 1: [1]

- Paragraph 2: [1]

- Paragraph 3: [1]

- Paragraph 4: [1]

- Paragraph 5: [1]

- Paragraph 6: [1]

- Paragraph 7: [1]

- Paragraph 8: [1]

- Paragraph 9: [1]

- Paragraph 10: [1]

- Paragraph 11: [2], [4]

- Paragraph 12: [1], [3], [5]

- Paragraph 13: [1], [6]

- Paragraph 14: [4]

- Paragraph 15: [1]

- Paragraph 16: [2], [3]

- Paragraph 17: [1]

Source: Noah Wire Services

- https://www.dailymail.co.uk/money/mortgageshome/article-14702487/Central-London-property-prices-crashed-wants-talk-warns-buying-agent.html?ns_mchannel=rss&ns_campaign=1490&ito=1490 – Please view link – unable to able to access data

- https://www.telegraph.co.uk/money/property/london-house-prices-fall-worst-to-come/ – In August 2023, The Telegraph reported that house prices in London had fallen by 0.6% over the past year, marking the first 12 months of negative growth in the capital since November 2019. The article highlighted that the average house price in London increased by £3,000 between May and June, but this was smaller compared to previous years, leading to a slowdown in annual house price inflation. Richard Donnell, executive research director at Zoopla, noted that the highest value housing markets are most exposed to higher mortgage rates and the impact on buying power.

- https://www.standard.co.uk/homesandproperty/luxury/prime-london-suburban-property-house-price-falls-b1128606.html – In December 2023, The Standard reported that house prices in London’s most expensive areas could be close to bottoming out after a turbulent year. The article cited research from Savills, which found that prime central London price falls had slowed, leaving property values down just 0.8% year on year. Looking forward, Savills forecasted flat prices in 2024 with prices rising by 18.7% by 2028. Sought-after west London areas, including Brook Green and Ealing, performed best in the final quarter of 2023, with prices remaining flat rather than falling.

- https://www.telegraph.co.uk/business/2023/10/26/london-property-sales-fallen-by-quarter-foxtons/ – In October 2023, The Telegraph reported that high interest rates had triggered a historic collapse in London’s property market, with sales in the capital down by nearly a quarter so far that year. Transactions in London dropped by 23% in the first nine months of the year, according to data from consultancy TwentyCi cited by Foxtons. The article noted that interest rates had climbed rapidly from just 0.1% in December 2021 to 5.25% at the time of reporting, leading to a surge in mortgage costs and shrinking house hunters’ purchasing power.

- https://www.standard.co.uk/business/london-house-price-property-sales-mortgage-loan-interest-rates-halifax-b1130578.html – In January 2024, The Standard reported that house prices in London dipped in 2023, even as prices elsewhere in the UK rose, according to new figures from Halifax. The average London home lost a little over £12,000 in value last year to £528,798, a fall of 2.3%. This was a long way from predictions of a double-digit decline made by economists when mortgage prices were soaring to 15-year highs. Craig Fish, director of Beckton-based broker Lodestone, commented that 2023 was very challenging for those looking to finance or refinance property, resulting in price reductions across the board, though not as deep as many expected.

- https://www.standard.co.uk/homesandproperty/property-news/property-values-prime-central-london-b1202002.html – In December 2024, The Standard reported that property values in prime central London had fallen amid post-Budget caution for wealthy buyers. The article noted that the prime central London market had dipped as wealthy buyers digested the implications of the Budget. Kensington Palace Gardens was mentioned as an example of prime central London property. The article highlighted that values for prime properties in the more domestic and debt-reliant outer London markets grew marginally over the past three months (+0.3%), led by growth in Hackney (+1.7%) and Shoreditch (+1.4%).

- https://www.telegraph.co.uk/money/property/london-house-prices-fall-worst-to-come/ – In August 2023, The Telegraph reported that house prices in London had fallen by 0.6% over the past year, marking the first 12 months of negative growth in the capital since November 2019. The article highlighted that the average house price in London increased by £3,000 between May and June, but this was smaller compared to previous years, leading to a slowdown in annual house price inflation. Richard Donnell, executive research director at Zoopla, noted that the highest value housing markets are most exposed to higher mortgage rates and the impact on buying power.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative references recent data and market conditions, indicating a relatively fresh perspective. However, specific data points like the 25% drop in the City of Westminster since January 2023 suggest it might be based on slightly outdated figures.

Quotes check

Score:

9

Notes:

The quotes from Jonathan Hopper, David Johnson, and Henry Pryor are specific and appear to be original to the narrative. Without access to extensive databases, it is challenging to verify if these quotes have been used previously elsewhere.

Source reliability

Score:

6

Notes:

The narrative originates from the Daily Mail, which is a well-known publication but may not always be considered the most reliable source for factual accuracy due to potential biases.

Plausability check

Score:

8

Notes:

The claims about property price declines in central London are plausible given the economic factors mentioned (e.g., rising interest rates and Brexit). However, specific statistics like a 25% drop in certain areas could require further verification.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative presents a plausible scenario of property price declines in central London, supported by recent data. However, the source reliability and specific figures might require additional verification for full accuracy.