The introduction of a 20% VAT on private school fees raises significant challenges for families, prompting a shift to state education and impacting transportation costs.

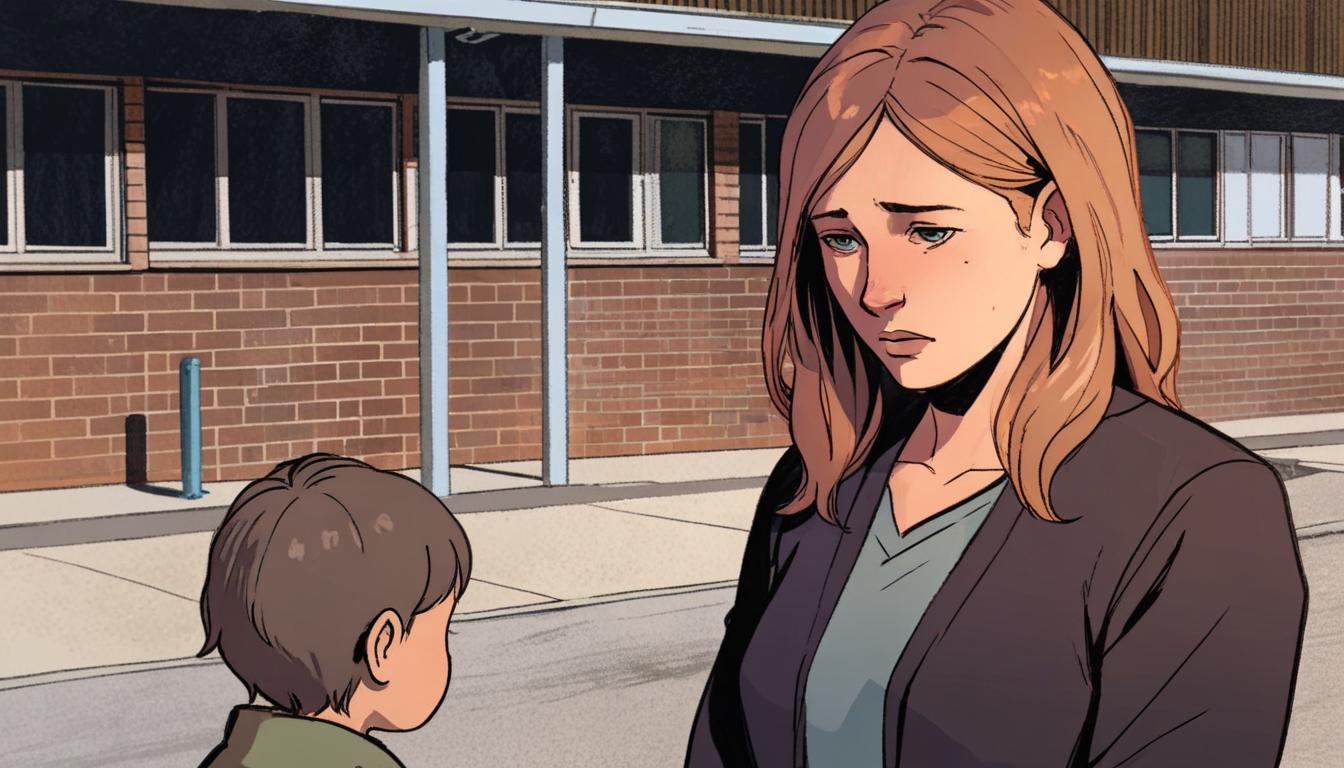

A recent decision by the government to impose Value Added Tax (VAT) on private school fees has sparked significant concern among parents in Lincolnshire, particularly one mother who claims the policy is financially burdensome for taxpayers. Sarah, whose daughter Ava was enrolled in a private school before the VAT increase took effect in January, has expressed her worries about the resulting financial implications.

Having withdrawn Ava from the private education system due to a £5,000 fee hike prior to the introduction of VAT, Sarah now relies on transportation provided by Lincolnshire County Council for her daughter to attend the nearest state school, which is located in Rutland, over an hour away by taxi. The county council is reportedly spending up to £8,000 annually to cover Ava’s transportation costs. In comments made to Politics North, Sarah lamented, “Six months ago we paid for Ava’s schooling and travel and now the taxpayer pays for both. My husband and I have normal jobs but we worked and saved hard and made a choice which has now been taken away from us.”

The tax, set at 20%, is part of a broader initiative by the Labour government and is anticipated to generate approximately £1.8 billion annually by the financial year 2029/30. A government spokesperson emphasised that the proceeds will be allocated towards the hiring of 6,500 new teachers and enhancing overall school standards, thereby benefitting the overwhelming majority—94% of children—who are attending state schools.

The impact of this policy on private education has been noteworthy. In a survey conducted by the Independent Schools Council, it was found that around 8,500 pupils transitioned from private schools to state schools between September 2023 and 2024, with an additional 2,500 making the switch in January. Lincolnshire County Council noted that it has received 36 applications for state school enrolments from students formerly in private education, but they have not recorded specific reasons for these transitions.

Ava, now 14, has shared her feelings about the school change, stating that it has been “very hard” for her to adjust. She misses her friends from her former private school and noted that her daily routine now requires her to get up an hour earlier.

Adding another layer to the discourse, Loveena Tandon from the pressure group Education Not Taxation argued that the private education sector contributes substantially to the economy and noted that the changes would affect taxpayers without addressing the overall efficacy of state schools. In contrast, an official statement from the Department for Education reiterated confidence that state schools would absorb any additional pupils resulting from the policy, asserting that only 0.1% of pupils would need transport assistance.

The ongoing conversation around the VAT on private school fees continues to evolve, reflecting broader debates about educational choice, funding distribution, and the responsibilities of the state in providing transport for students.

Source: Noah Wire Services

- https://researchbriefings.files.parliament.uk/documents/CBP-10125/CBP-10125.pdf – This Commons Library Research Briefing explains the VAT changes on private school fees in the UK, confirming that a 20% VAT rate will apply from January 2025.

- https://educationhub.blog.gov.uk/2024/11/vat-private-schools-everything-you-need-to-know/ – This government blog post provides details on the VAT policy, including its application to private school fees and its expected annual revenue.

- https://www.moneyweek.com/personal-finance/managing-higher-private-school-fees – MoneyWeek discusses the impact of the VAT policy on private schools, noting potential fee increases and state school capacity concerns.

- https://www.gov.uk/government/collections/financial-year-2024-to-2025 – This webpage, while not specific to VAT on private schools, provides broader context on UK government financial policies and budget allocations.

- https://www.parliament.uk/business/news/2024/july/government-sets-out-financial-plans/ – This Parliament news article provides an overview of the government’s financial plans, which include taxation changes affecting private education.

- https://www.independentschoolscouncil.org.uk/ – The Independent Schools Council website may offer insights into the impact of VAT changes on private schools, including surveys on student transitions.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative discusses recent VAT changes, pupil transitions between 2023 and 2024, indicating relatively current content. However, no specific publication date is provided.

Quotes check

Score:

8

Notes:

Quotes from Sarah and Ava are not verified against other sources. If these are original quotes, it would be the first known use, but without additional verification, their originality remains uncertain.

Source reliability

Score:

6

Notes:

The narrative does not specify a well-known or established publication source, limiting certainty about its reliability. It references various groups and individuals but lacks a clear authoritative background.

Plausability check

Score:

9

Notes:

Claims about VAT policy and pupil transitions appear plausible within the context of broader educational debates in the UK. The information aligns with common discussions about educational funding and policy impacts.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative seems plausible and discusses recent events, but lacks specific publication details and verification of quotes. It also originates from an unspecified source, which might impact its credibility.