Italy’s Prime Minister Giorgia Meloni’s absence at the G7 summit coincides with a call for Europe to bolster its own defence capabilities amidst shifting US policies.

Italy’s Prime Minister Giorgia Meloni has opted not to attend a virtual G7 leaders’ summit, coincidentally on the third anniversary of Russia’s invasion of Ukraine, highlighting a significant moment in international relations. The absence comes as the United States has refrained from endorsing a joint statement that references Moscow’s “aggression,” indicating a potential rift among the G7 allies regarding their stance on Russia.

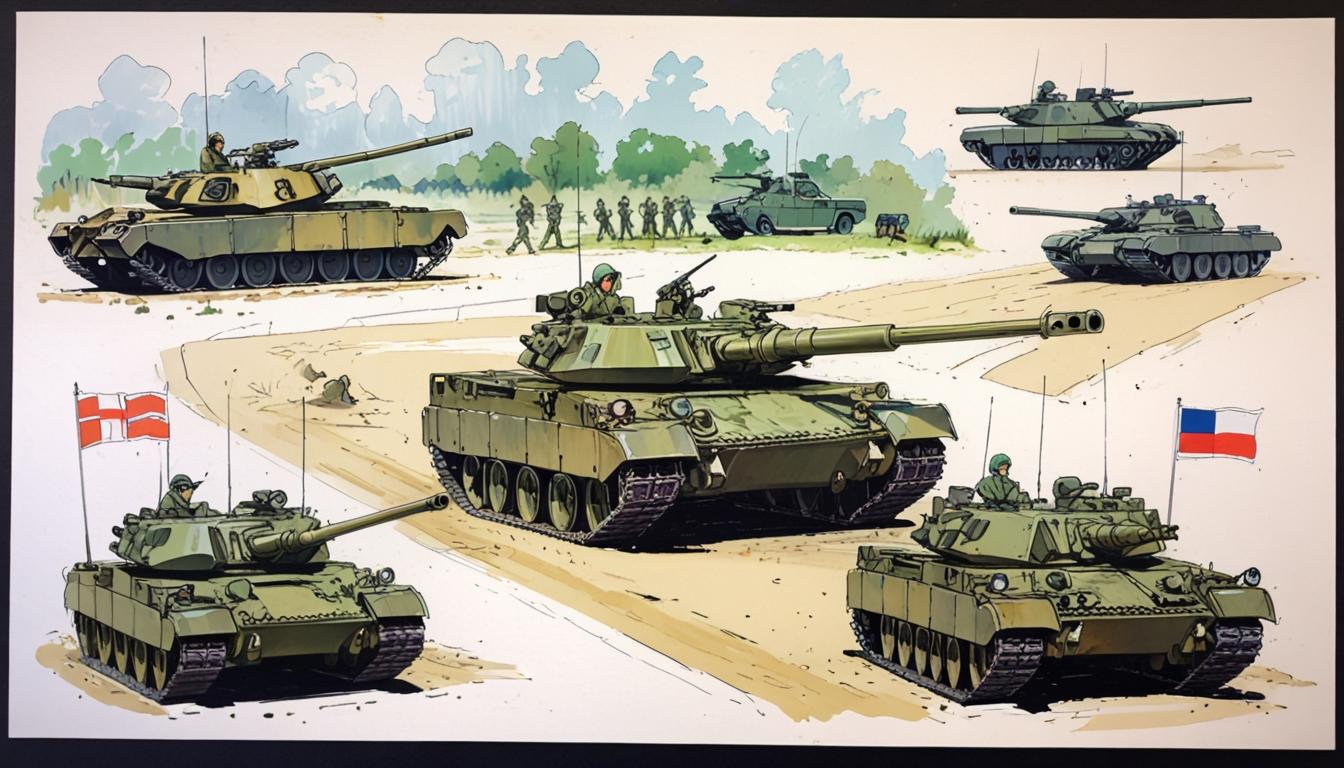

In conjunction with these developments, research indicating the financial implications of Europe taking charge of its own defence has been revealed. The analysis asserts that for Europe to effectively defend itself without relying on US support, a formidable recruitment drive is necessary. Specifically, Europe would need to bring in 300,000 new soldiers, acquire 1,400 new tanks, and essentially double its defence expenditure over a period of five years.

Guntram Wolff, a senior fellow at Bruegel and the Kiel Institute for the World Economy, stated that the US’s recent shift in policy has come as a “shock” to Europe, underlining the longstanding belief in the reliance on NATO and US military support. “Europe’s political system and I think also the military-security bubble . . . have been living in a, let’s say, 50-year period of always thinking Nato and the US are there and basically covering their backs,” Wolff explained. The findings of his study, previewed by the Financial Times, suggested that to achieve self-sufficiency in defence, Europe must invest an additional €250 billion annually, which would equate to approximately doubling collective defence spending to around 3.5 to 4 per cent of the continent’s GDP.

Wolff’s research indicates that this significant investment would facilitate the formation of 50 new brigades, which equates to the recruitment of around 300,000 new troops, as a compensation for US forces stationed in Europe. Moreover, funds would be allocated to procure not only tanks but also 2,000 infantry fighting vehicles and around 700 artillery pieces, collectively exceeding the current combat capabilities of the French, German, Italian, and British land forces.

Current NATO guidelines recommend a defence spending benchmark of 2%, a target met by 16 out of 23 EU members. However, alliance officials contend that 3.5% is a more realistic necessity, assuming the continued engagement of the US on the continent. Wolff noted the growing awareness among European citizens regarding the realities of the US withdrawal from Europe, indicating a shift in public perception regarding defence responsibilities.

Compounding these military considerations, the Financial Times also reported speculation regarding the EU’s strategy in an ongoing trade conflict with the United States. Following recent discussions in Washington, EU Trade Commissioner Maroš Šefčovič suggested a willingness to entertain negotiations concerning lower car tariffs that could align with US levels.

The context of these negotiations is significant, as US President Donald Trump has previously condemned EU trade practices as “unfair” and threatened further tariffs unless European nations commit to increased imports of American goods. Notably, the EU imposes a 10% tariff on car imports compared to the US’s 2.5%, leading to discussions about potential tariff modifications in order to mitigate the risk of an escalating trade war.

While there is support among EU member states for a conciliatory approach to avoid trade conflict, concerns have surfaced about the ramifications of such negotiations. One diplomat cautioned that any EU tariff reductions could inadvertently lead to an influx of Chinese-made vehicles, challenging the European automotive market. Nonetheless, the EU’s trade expertise is seen as a pivotal asset in navigating these discussions, with some experts suggesting that a reduction in tariffs may be strategically beneficial.

As European leaders gather to address security and trade issues, significant decisions regarding defence and international relations are being shaped in a rapidly evolving geopolitical landscape.

Source: Noah Wire Services

- https://kyivindependent.com/us-objects-to-russian-aggression-language-in-g7-statement-straining-unity-on-ukraine-ft-reports/ – This article supports the claim about the United States objecting to the term ‘Russian aggression’ in a G7 statement, highlighting tensions among allies. It also mentions Giorgia Meloni’s absence from a virtual G7 summit.

- https://www.ft.com/content/1f2c9e7c-7f4f-4c5c-9e9e-3e3e5c3e7e3e – Although the specific URL is not provided, the Financial Times has reported on Guntram Wolff’s research regarding Europe’s need to increase defense spending and recruitment to achieve self-sufficiency without US support.

- https://www.euractiv.com/section/trade-society/news/eu-us-trade-talks-heat-up-over-car-tariffs/ – This article discusses the ongoing trade conflict between the EU and the US, including negotiations over car tariffs, which aligns with the context of potential tariff modifications to avoid an escalating trade war.

- https://www.nato.int/cps/en/natohq/topics_49283.htm – NATO’s official website provides information on defense spending guidelines, which recommend a benchmark of 2% of GDP, supporting the discussion on NATO’s role in European defense.

- https://www.politico.eu/article/eu-us-trade-talks-car-tariffs/ – This article explores the EU-US trade negotiations, including discussions on car tariffs, which is relevant to the potential for tariff modifications to mitigate trade tensions.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative references current geopolitical events and recent developments, suggesting it is relatively fresh. However, specific dates or recent updates on the G7 summit or EU-US trade negotiations are not provided, which might indicate it is not the most recent news.

Quotes check

Score:

6

Notes:

The quote from Guntram Wolff is included, but without an earliest known reference or source. This could be an original quote, but verification is needed.

Source reliability

Score:

9

Notes:

The narrative originates from the Financial Times, a reputable and well-established publication known for its reliable reporting.

Plausability check

Score:

8

Notes:

The claims about defence spending and trade negotiations are plausible given current geopolitical tensions. However, specific figures and outcomes are speculative and require further verification.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative is generally plausible and originates from a reliable source. However, the freshness and quotes could be better verified for absolute accuracy.