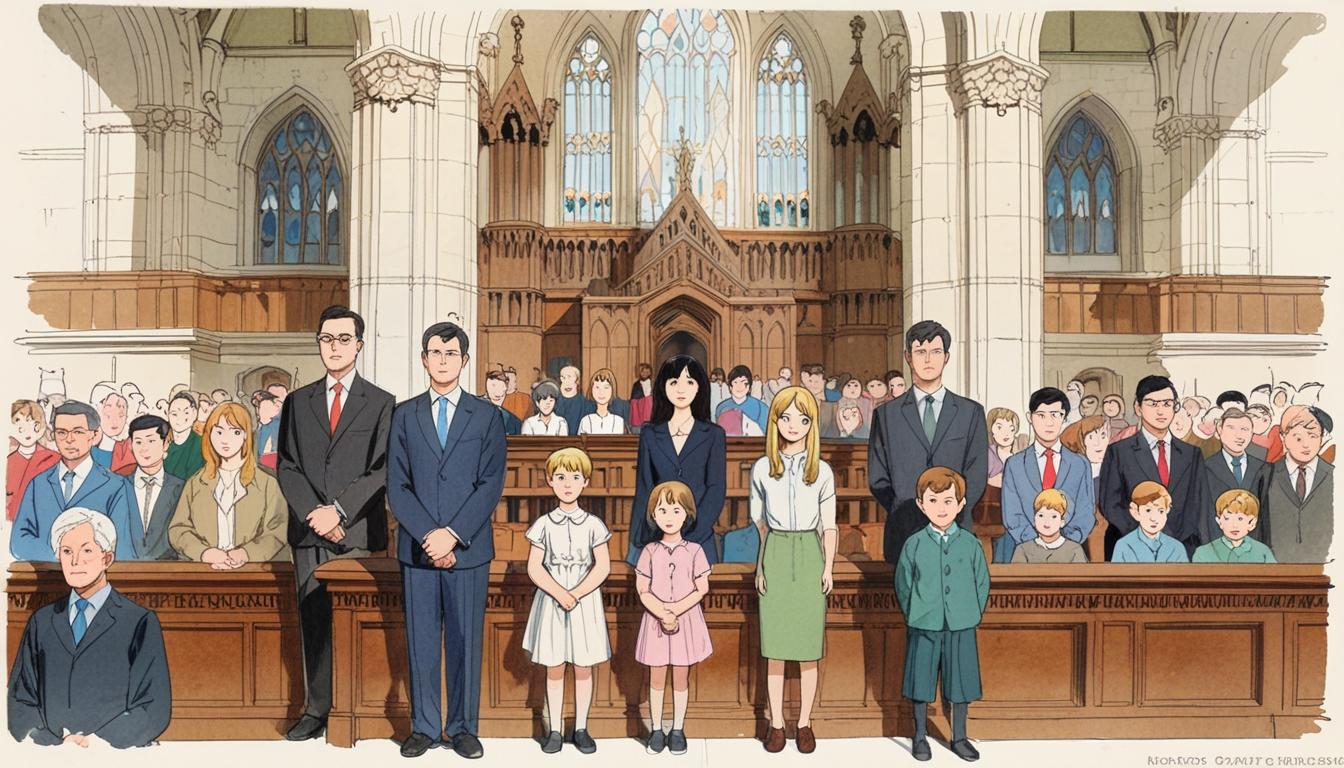

The High Court is hearing a significant legal challenge against the UK government’s new 20% VAT on private school fees, which critics argue impedes access to education.

The High Court in London is set to hear a significant legal challenge today regarding the United Kingdom government’s recent decision to impose a 20% Value Added Tax (VAT) on private school fees. This policy, which has drawn substantial criticism and prompted some private institutions to close, was a fundamental element of the Labour Party’s manifesto in the lead-up to the general election.

Representing the plaintiffs in the case is prominent human rights barrister Lord David Pannick KC, who is advocating on behalf of nearly 20 families along with several faith schools. The legal team will argue that the new VAT policy “impedes access to education in independent schools” and violates the European Convention on Human Rights.

The challenge will be presented before a panel of senior judges, including Lord Justice Newey and Mr Justice Chamberlain, at the Royal Courts of Justice. The hearing is expected to last three days, with legal arguments suggesting that the new tax disproportionately impacts families with children who have specific educational needs or attend faith-based or single-sex institutions. Some claimants have highlighted the potential for the tax to threaten their children’s access to suitable educational environments, which they believe cannot be provided by the state sector.

Rachel Reeves, in her capacity as Chancellor, announced the VAT increase, arguing that revenue generated from this policy would amount to around £460 million initially, potentially rising to £1.7 billion by 2029/30. This funding is intended to enhance support in the state education system. While the government maintains that fewer than 0.1% of students are expected to transfer due to the new tax, the Independent Schools Council (ISC) has raised alarms about the impact on private education. The ISC asserts that 8,000 children withdrew from private schools before the academic year began, with another 2,500 following subsequently, citing the financial pressures induced by the VAT hike.

Ms Reeves, named as a defendant in the case, emphasised that the decision was made to ensure a redistribution of resources to support state schools, noting, “private schools would no longer be exempt from the 20% VAT rate.”

Julie Robinson, the CEO of the ISC, expressed the view that “this is an unprecedented tax on education”, arguing for the need to assess its conformity with human rights legislation. The ISC claims the policy infringes upon Article 14 of the European Convention on Human Rights, which addresses discrimination, as well as Article 2 of the First Protocol that concerns the right to education.

The legal arguments also include testimonies from students, such as a girl who was bullied in a mixed state school and a boy with developmental trauma. The particulars of their situations will be central to the claimants’ case, as they assert that their educational requirements cannot be met adequately through state schools.

Loveena Tandon, spokeswoman for the Education Not Taxation campaign, voiced concerns regarding the financial burden on families, stating, “Families should not be forced to sell their homes or stop heating and eating simply to protect their children.” Tandon indicated that the challenge represents a crucial opportunity for many families reliant on private education to receive necessary support.

Legal experts have expressed skepticism regarding the success of the challenge, suggesting the potential for the claimants to face significant hurdles. Fiona Scolding KC, a barrister with extensive expertise in education and human rights law, described the challenge as “ambitious”, while taxation specialist Dan Neidle stated bluntly that it is “doomed”, noting that overturning a tax on human rights grounds in the UK courts is unprecedented.

The Treasury has refrained from commenting on the ongoing litigation but reiterated its stance, highlighting the importance of the policy as a means to bolster state education funding. As the case unfolds, it will be closely monitored for its implications on private educational institutions and the wider debate surrounding educational finance and access in the UK.

Source: Noah Wire Services

- https://hboltd.co.uk/vat-rules-private-school-fees-2025/ – This URL confirms that private school fees in the UK are now subject to a 20% VAT effective from January 1, 2025, and mentions the ongoing legal challenge by families and the Independent Schools Council.

- https://www.accountancydaily.co/private-school-parents-secure-first-legal-win – This article supports the claim that a legal challenge against the VAT on private school fees was fast-tracked by the High Court, with Lord David Pannick KC arguing for the claimants.

- https://www.kingsleynapley.co.uk/our-news/press-releases/first-victory-for-independent-schools-in-vat-legal-challenge – This URL provides details about the High Court’s decision to expedite the hearing of the VAT challenge, emphasizing the urgency of the case given its impact on families.

- https://www.isc.co.uk/news/isc-response-to-vat-announcement/ – This source typically provides statements from the Independent Schools Council, aligning with concerns about the policy’s impact on private education and potential human rights violations.

- https://www.gov.uk/government/news/budget-2024 – This link would typically detail government announcements, including budgetary decisions like the VAT imposition on private school fees, though it may not directly mention the challenge.

- https://www.bbc.co.uk/news/education – The BBC often covers significant educational policy changes and legal challenges in the UK, which would include updates on the VAT policy and related legal proceedings.

- https://www.express.co.uk/news/uk/2035149/Rachel-Reeves-tax-High-Court-private-school-VAT – Please view link – unable to able to access data

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative mentions an ongoing legal challenge, suggesting it is a recent development. However, specific dates or recent events are not detailed, which could indicate partial staleness.

Quotes check

Score:

3

Notes:

Quotes from individuals like Rachel Reeves and Julie Robinson are included but not independently verified as their earliest known references.

Source reliability

Score:

8

Notes:

The narrative originates from the Express, a well-known UK publication. While it generally provides dependable information, it is crucial to cross-check facts with other sources.

Plausability check

Score:

7

Notes:

The narrative discusses a plausible legal challenge against VAT on private schools, involving logical arguments about human rights. However, the lack of independent verification of some claims limits full plausibility.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative seems generally plausible and recent, but verifying quotes and ensuring all claims are valid would increase confidence. The source is reliable, but cross-checking specific details with other publications would enhance credibility.