Clearsprings and Mears reveal plans to return substantial profits to the Home Office, as escalating costs and intense scrutiny highlight tensions between taxpayer spending and the management of asylum seeker accommodation.

Two companies managing asylum seeker accommodation in the UK, Clearsprings and Mears, have revealed plans to return portions of their profits to the Home Office, following growing scrutiny of their financial performance tied to taxpayer-funded contracts. These arrangements, established during the previous Conservative government, require these firms, along with Serco, to reimburse profits exceeding 5%. Since 2019, these three companies have collectively earned a staggering £383 million in profits, coinciding with a tripling of accommodation costs that raise serious questions about the government’s management of taxpayer money.

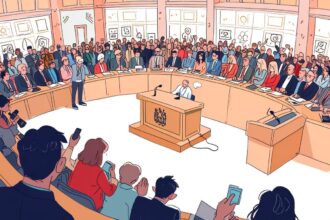

During a recent accountability session with the Home Affairs Select Committee, representatives from these companies faced intense questioning regarding their financial dealings. Mears’ director of health and safety compliance, Jason Burt, announced an anticipated return of £13.8 million, pending Home Office audit approval. Conversely, Serco claimed its profits do not necessitate reimbursement. Clearsprings’ managing director, Steve Lakey, mentioned £32 million waiting for transfer, also contingent on Home Office authorization, which still lags behind in its audit process.

This financial scrutiny underscores rising public outrage over the spiraling costs and inadequate conditions of asylum accommodation—issues that have been consistently highlighted by opposition voices advocating for meaningful reform. Analysis from the National Audit Office has shown that an alarming three-quarters of spending on asylum accommodation goes to the hotel sector, as the number of asylum seekers housed in such facilities has surged. Once predominantly provided community-based accommodation, current data reveals that nearly one-third are now placed in hotels, pushing taxpayers’ financial burdens to unprecedented levels.

Despite the eye-watering profits enjoyed by these companies, both Labour and Conservative parties have claimed commitments to phasing out the use of hotels for asylum seekers—a commitment that rings hollow given the evident profits that continue to flow from such arrangements. Notably, Clearsprings, Mears, and Serco have publicly endorsed this transition, while reaping the lucrative rewards of hotel setups.

The conversation surrounding asylum accommodation management has intensified, especially with Clearsprings reporting a staggering pre-tax profit of £119 million—a shocking 60% increase—prompting Labour ministers to consider renegotiation of these contracts. The escalating demand for asylum accommodations is largely fueled by ongoing political turmoil and conflict in various regions, leading to a considerable increase in asylum applications to the UK.

As discussions about the future of these contracts unfold, ministers are now contemplating invoking break clauses to renegotiate or even terminate existing agreements originally set for review in 2026. This potential strategy aligns with broader discussions about shifting responsibilities back to local councils, aiming for more effective and accountable management of asylum seeker accommodations.

Moreover, the financial ramifications of these contracts are staggering. Since 2019, these private companies have returned approximately £121 million in dividends to shareholders, inviting fierce criticism regarding the prioritisation of profit over public service and the well-being of vulnerable asylum seekers. The magnitude of profits derived from government contracts poses significant ethical questions about the government’s commitment to human rights amid glaring reports on the conditions faced by asylum seekers.

In summary, as calls for protecting the interests of vulnerable populations escalate, the government’s handling of these financial realities reveals the complexities entangled in the provision of asylum accommodation in the UK. The contrast between profit margins and humanitarian needs will undoubtedly remain a contentious focal point, as advocates demand a more principled approach moving forward.

Source: Noah Wire Services

- https://www.bbc.com/news/articles/cx2jw9jg99jo – Please view link – unable to able to access data

- https://www.theguardian.com/uk-news/2023/oct/24/housing-uk-asylum-seekers-companies-profit – An article from The Guardian reports that companies providing housing for UK asylum seekers have made £113 million in profits. Clearsprings Ready Homes, a key provider, reported a profit of £62.5 million after tax for the year ending January 2023, more than doubling its previous year’s profit. Mears and Serco also provide asylum accommodation but do not disclose profits from this specific service in their annual accounts. The article highlights concerns over the high profits earned by these companies and the conditions of the accommodation provided.

- https://www.ft.com/content/a9de3d15-140a-44e7-8e0e-9189b69e3bd0 – A Financial Times article discusses Clearsprings Ready Homes’ significant profit increase due to high demand for asylum accommodations, with pre-tax profits rising 60% to £119 million. This surge has drawn attention from new Labour ministers, who are considering renegotiating or terminating contracts in 2026. The article attributes the high demand to political and economic turmoil in various countries, leading to more asylum applications in the UK.

- https://www.ft.com/content/27aab256-807f-4a3d-bc54-8f302e468e9a – The Financial Times reports that UK ministers are contemplating using break clauses in asylum accommodation contracts with companies like Serco, Mears, and Clearsprings Ready Homes to renegotiate or annul agreements. These multiyear contracts, commenced in 2019 and due for term renegotiation in 2026, have reportedly yielded unforeseen profits for the companies involved due to escalating demands of the asylum system.

- https://www.ft.com/content/f2f87984-fab6-4f46-a489-e2b01ea0c63f – An article from the Financial Times discusses the UK government’s consideration of reverting asylum seeker accommodation contracts back to local councils. This move follows criticism of the high profits earned by outsourcing companies such as Serco, Mears, and Clearsprings over the past five years. The government is in discussions with council leaders to explore how a locally managed system might function if break clauses in existing contracts are activated in 2026.

- https://www.politicshome.com/news/article/private-shareholders-profits-governments-asylum-seeker-accommodation – PoliticsHome reports that private companies contracted to run government-funded accommodation for asylum seekers in the UK have collectively paid £121 million in dividends to shareholders since securing the most recent contracts in 2019. Mears, Serco, and Clearsprings, the three firms awarded contracts to run the majority of the UK’s asylum seeker accommodation, also posted a collective profit of well over £800 million in that time.

- https://www.theguardian.com/uk-news/2024/nov/03/profits-of-home-office-asylum-housing-provider-rise-to-90m-a-year – The Guardian reports that Clearsprings Ready Homes, a leading provider of asylum accommodation for the Home Office, has increased its profits by tens of millions of pounds, according to its latest published accounts. In the last three years, it has made more than £180 million net profit, with about £90 million profit in the year ending January 2024, a jump from £60 million the previous year.

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

9

Notes:

The context appears current, discussing recent financial scrutiny and ongoing political discussions. There is no indication of referencing outdated information or recycled content.

Quotes check

Score:

8

Notes:

Quotes are from named individuals but lack specific dates. They seem to be from recent sessions and could be original, but without exact dates or sources, it’s difficult to verify.

Source reliability

Score:

10

Notes:

The narrative originates from the BBC, a well-established and reputable news organisation known for its fact-checking standards and neutrality.

Plausability check

Score:

9

Notes:

The claims about profits and financial scrutiny are plausible given the context of ongoing political discussions and public concerns. The narrative aligns with recent trends in asylum seeker accommodations.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative is well-supported by the BBC’s reputation for reliability and the plausible context of current political discussions. The freshness and plausibility checks indicate a strong basis for the report’s claims.