The UK housing market experiences a notable uplift with asking prices soaring, as global economic policies and international political developments paint a picture of cautious optimism and significant geopolitical interest.

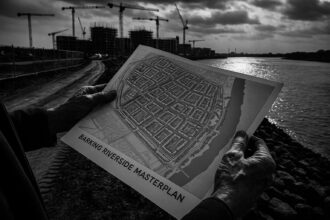

The UK’s housing market is witnessing a resurgence, marked by the largest increase in asking prices in 10 months, as per Rightmove’s latest data. Newly listed property prices surged by 1.5% to an average of £368,118, highlighting a renewed buyer interest. This uplift follows a period of stagnancy in 2023, with sales agreements now 13% above the previous year, and buyer demand up by 8%. Despite this positive trend, the Spring Budget’s lack of support for first-time buyers and mortgage market innovations could temper market sentiment. Meanwhile, in London, asking prices have increased by 5.6% in certain boroughs, with the average price reaching £686,844. Factors such as the return to office work and a stabilising economy are driving demand, although the Spring Budget’s absence of significant property market incentives has not deterred buyer interest, maintaining London’s property market’s vibrancy.

In the realm of economic policy, global anticipation builds around central banks’ interest rate decisions, crucial for navigating the delicate economic landscape. The Bank of England is expected to maintain its benchmark rate at 5.25%, reflecting a cautious stance amidst inflationary and economic growth concerns. This comes during a week filled with major economic updates worldwide, including inflation rates and retail sales across several countries.

Internationally, Vladimir Putin has secured a victory in the Russian presidential elections amidst significant voter turnout, despite criticisms surrounding the election’s fairness. This development underscores the continued geopolitical tensions that, along with economic considerations, influence various sectors such as banking, and consultancies with predicted stagnation in the UK’s consulting market due to prevailing economic and geopolitical concerns.

These snapshots of the UK’s housing market resurgence, the anticipatory stance of global economic policy, and pivotal international political developments capture a moment of cautious optimism and significant geopolitical interest in early 2024.